Roberto Morales Chang

Roberto Morales Chang has a bachelor’s degree (BA) in Economics with Finance specialization, Cum laude, from Universidad Francisco Marroquin.

He’s an assistant professor at UFM’s Henry Hazlitt Center for the courses Economic Process I and Economics Process II.

Some of his areas of interest but not limited to are monetary theory, financial economics, history of economic thought, economic history and entrepreneurship.

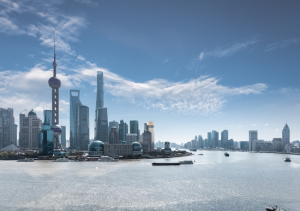

If banks could understand the opportunities that could be created by slightly changing the current scheme, China coud grow at a pase faster than 5%.

Click here to continue readingThe 2008 crisis was provoked by a credibility gap created by financial instruments used during transactions conducted by shadow banking entities. These instruments are called credit derivatives and examples include credit default swap (CDS) and asset backed securities (ABS).

Click here to continue readingThere exist two industries that did not manage to reach analyst estimates and experienced a sharp decline in earnings: oil and the banking industry. The European Central Bank has once again decided to continue with negative interest rates and contribute to credit expansion where lowering of interest rates and increasing in borrowing are facilitated.

Click here to continue readingThe efficient-market hypothesis becomes questionable with the phrase “sell in May and go away”, because if really the case, the market will have already reflected the available information and the value of the stock before May arrives.

Click here to continue readingThe political landscape is also making headlines around the world: there is a growing trend supporting Europe’s extreme left and right with the result of the German referendum last week, the possible outcome of the US primaries, Jeremy Corbyn’s support from the United Kingdom, and France’s extreme right.

Click here to continue readingOn December 31, the Hamburg based German investment bank Berenberg issued a recommendation regarding the Varoufakis Effect and the importance it will have in 2016. The Varoufakis Effect refers to a country’s political risk, often times brought about by government officials and owes its name to Greece’s ex-finance minister, Yanis Varoufakis. Berenberg Bank explains how confidence levels in Greece declined during Varoufakis’s time as finance minister and suddenly picked back up upon his resignation. It is important to make mention of the fact that, in response to this theory, Yanis Varoufakis himself explained that this correlation doesn’t necessarily signify causation. Such a case can be exemplified in Argentina with Mauricio Macri and his taskforce.

Click here to continue readingOne of the most relevant news stories of last year, if not the most important in the world of finance and economics, was the 0.25% increase of the Federal Funds Rate by the Fed on December 16. The increase marks the end of a period where U.S. interest rate had been close to 0%. Furthermore, the Fed announced it would possibly continue to raise interest rates throughout 2016.

Click here to continue readingGet our free exclusive report on our unique methodology to predict recessions