The Honduran Supreme Court of Justice declared the law that underpins the Honduran special economic zones (ZEDEs) unconstitutional with retroactive effects.

Click here to continue readingU.S. banks are increasingly resorting to the Fed’s discount window

Click here to continue readingA freshly proposed Latin American common currency is making an appearance in the continent in which most countries resemble Greece

Click here to continue readingHow do we hold bureaucrats responsible for eroding the purchasing power of our money?

Click here to continue readingUS companies see their profits fall by 10 percent in two quarters

Click here to continue readingThe Nobel Prize in Economics is becoming increasingly politicized

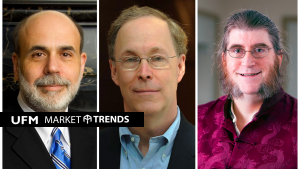

Click here to continue readingA quick guide to understand the Diamond-Dybvig model of two of the three recent Nobel Prize winners

Click here to continue readingThe 2022 recession claims its first victim: the UK financial sector

Click here to continue readingLast year, I wrote that the current inflation has a fiscal rather than a monetary origin. In other words, we would not have the same inflation in the absence of fiscal stimulus, while we would have the same inflation in the absence of monetary stimulus. For the same reason, I have affirmed and continue to affirm that I view it as unlikely for current inflation rates to begin to consistently exceed two digits, as was the case in the 1970s. This same pandemic fiscal stimulus has caused serious problems in a variety of markets: sea, land and air freight, electronic products and their components, automobiles, and others, which have added fuel to the inflationary fire. This is the origin of the current inflation we are experiencing, and I will try to make my case with data. The Current Inflation In recent months, the rise in the general price level has…

Click here to continue readingRecession and inflation are already here. Will unemployment follow?

Click here to continue readingGet our free exclusive report on our unique methodology to predict recessions