The Strength of the Spanish Economy Surprises Amidst Disappointing Global Growth

Spain’s Unexpected Economic Performance

Commentary on the 5th UFM Market Trends Spain report on the 2nd Quarter of 2016.

As Spain’s politicians discuss the urgent need to form new government, the Spanish economy surprises the world with its strength. The inability to implement reforms and new measures due to the absence of a ruling government would be devastating if such steps were needed. However, a healthy skepticism towards politics in general—the Spanish ideological and political landscape in particular—makes such a scenario unlikely.

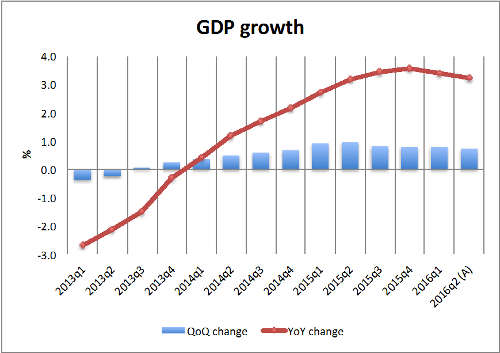

As some debate over Spain’s future, others produce goods and services. The data analyzed in the new quarterly report by UFM Market Trends and Instituto Juan de Mariana on Spain’s economic situation shows a strong annual growth rate of 3% for the European country.

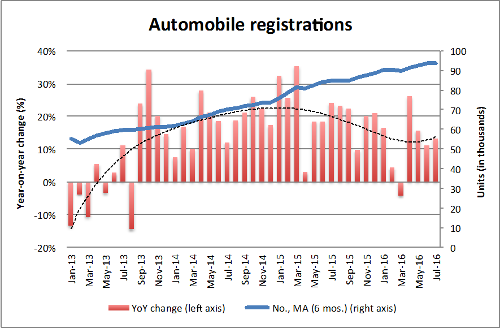

The graph shows a minor slowing in both activity and employment, according to the Labor Force Survey for this year’s second quarter. The PMI (Purchasing Managers Index) shows a more negative note, specially for the manufacturing sector. On the other hand, the leading indicators of cyclical sectors, such as automotive and real estate, as well as the employment data for July do not reinforce these signals.

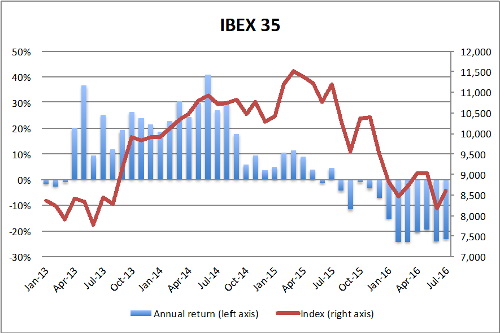

From a financial perspective, there continues to be an investor appetite for fixed income, seen in the context of the asset purchase policy by the European Central Bank. Bond gains have yet to reach the ground, and the 10-year yield dropped below 1%. By contrast, IBEX 35 recorded losses by over 20%, in annual terms; a number that is not far away from European references. The banking sector, heavily weighted in the Spanish index, gets the worst of it: its losses doubled since last year.

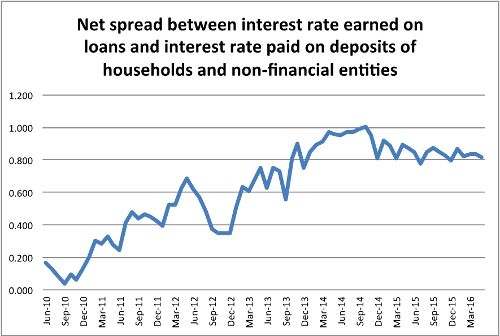

Many blame the current rate environment for the problems that banks are facing. However, other factors play a larger role. As discussed in the report, the net interest margin only began to decline in late 2014, and is currently at higher levels than those of the period from 2010 to 2012.

The household and non-financial corporation sector continues to reduce its total assets. At the same time the percentage of doubtful assets over total is also reduced. The growth rates of credit stock—without those given to the government—have rebounded in recent months, supported by the good performance of family consumer credit and the rise of business.

The data analyzed in the report points to a stabilization of annual growth rates of about 3%. The major macroeconomic shortcoming that remains is high public deficit—a problem that most likely will not be fixed in the short term. Likewise, the magnitude of Spain’s debt position against the outside is a future weakness. These two risk factors have been reiterated in each one of the reports.

More details about the Spanish economy can be found in the second quarterly report of 2016 by UFM Market Trends.

Get our free exclusive report on our unique methodology to predict recessions

Ángel Martín Oro

Ángel Martín Oro is VP of Spain at UFM Market Trends in collaboration with Instituto Juan de Mariana. He is also a PhD-candidate in economics. He is also a senior consultant at iDen Global and was previously an editor at the financial portal inBestia.com. In addition, he is a professor of the OMMA Master of Economics. He is the author and co-author of numerous reports and articles, published in Spanish and international media, such as the Wall Street Journal and the Cato Institute.

Get our free exclusive report on our unique methodology to predict recessions