Mexico’s Flattening Yield Curve: A Crisis Sign?

The yield curve is one of the most important indicators to understand economic cycles. The yield curve shows the different interest rates that are paid at different terms. Naturally, the yield curve has a positive slope, assuming that the longer the term, the higher the interest rate of the debt.

A “normal” yield curve:

This idea is consistent with the assumption that the interest rate is composed by the maturity premium, a risk premium, and a liquidity premium. Since the yield curve expresses the normal interest rate, we have to add the premium for the expected inflation. These four factors explain the composition of the interest rate at different terms.

Our report titled “The economic cycle as a degradation of liquidity” explains, adjusting the yield curve creates general losses of liquidity because liabilities mature at a shorter terms than assets. If the situation generalizes, long-term interest rates will fall until they are equal to short term interest rates and the yield curve will flatten.

This is why the flattening of the yield curve is usually a good indicator of whether the economy may be close to a recession. This is the argument that my colleague Olav Dirkmaat uses to confirm that there is a recession risk in the United States due to an increase in short-term interest rates.

The Mexican Case

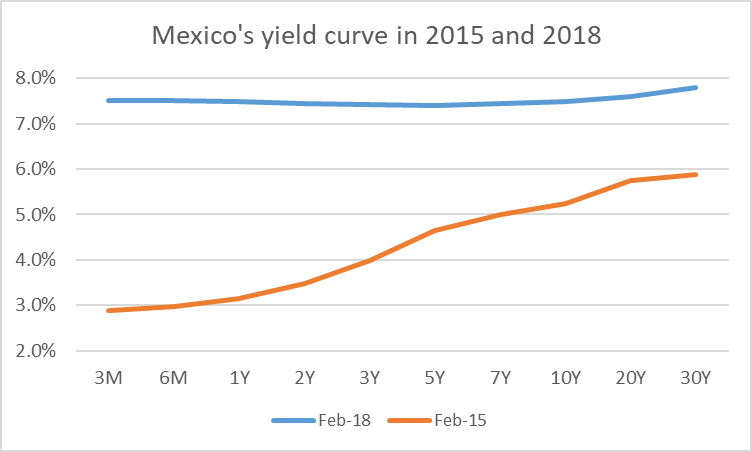

If we look at Mexico, we can see how the slope of the rate curve has changed in the last three years.

Source: Banxico

What has happened to the yield curve?

Since the end of 2013, the benchmark (short term) interest rate of Banxico had been at 3%. However, ever since the Fed announced the increase in interest rates in December 2015, given the rate of depreciation of the Mexican peso and the subsequent inflation, Banxico began to respond with increases in its target interest rate. The last rate hike by Banxico was on February 8, 2018, when increasing it from 7.25% to 7.5%.

This is why we compare the yield curve between 2015 and 2018. The deterioration of Mexico’s trade balance began in 2015 due to oil prices and it was the factor that triggered the depreciation of the Mexican peso.

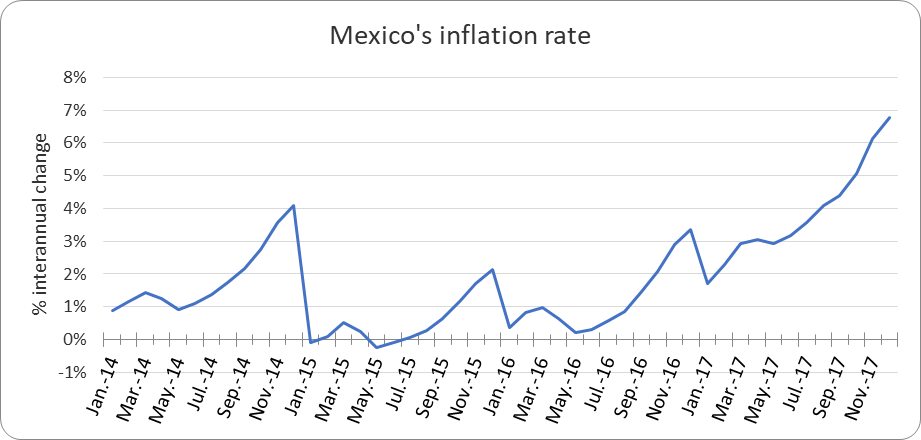

Naturally, the depreciation was not immediately transmitted to domestic prices. In fact, the drop in the price of oil initially meant a decrease in domestic prices. Inflation in 2015 closed at 2.15%, the lowest since the existence of the Mexican peso. However, as shown in the graph, in mid-2016 the depreciation began to affect domestic prices and Mexico closed 2017 with its highest inflation in 17 years at 6.77%.

Source: Inegi

That is why we can confirm that the rate curve has flattened due to inflation expectations and not because the economy is reflecting concerning liquidity problems. Since inflation is expected to be high in the short term but to decrease when the Mexican economy is adjusted, we see a flat rate curve. However, long-term interest rates do not accompany the high rise of short-term interest rates because the expectation of long-term inflation is lower.

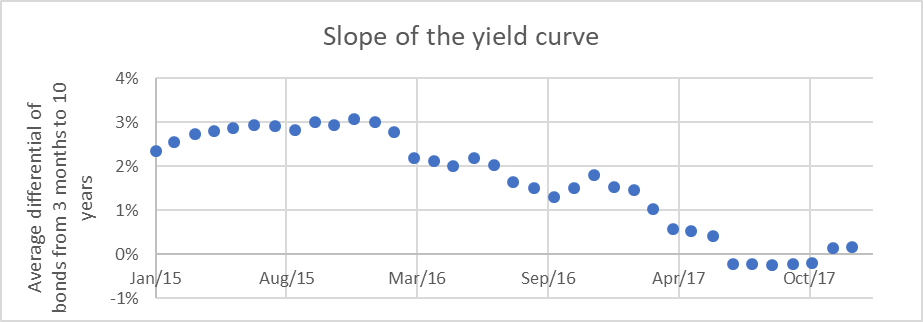

Source: Made with data from Banxico

The graph above is one of the indicators we use at UFM Market Trends for our semi-annual reports. The slope of the yield curve shows the differential between the three-month interest rate and the ten-year interest rate. We see that the reduction in the interest rate differential coincides with the rebound in Mexico’s inflation rate. We can speculate that as the purchasing power of the Mexican peso recovers, the rate curve will normalize.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions