Banking Panic in China

Bad news seems to keep coming for China’s economy. In this article I analyze the health of the Chinese banking sector. There are growing doubts about the solvency of the sector, especially since a few Chinese banks have frozen their customers’ deposits. Freezing deposits means people cannot access their bank accounts to withdraw or even transfer their money and they cannot make purchases or any kind of payment. This is causing depositors to protest.

This article seeks to explain why some banks have frozen their customers’ deposits in China.

When Did the Problem Start?

Although the problem began earlier, the alarm bells started ringing in April 2022, when several rural banks in two provinces—namely, Henan and Anhaui—suspended payment of their deposits.

Regional banks in China are prohibited from raising funds, whether by deposit or otherwise, from outside their region. The official reason for freezing the payments is that the banks in question raised money online from outside their own region.

The problem with the official reason is twofold:

- The banks could have frozen only deposits suspected of having come from outside their region, not all deposits, if they had wanted to.

- Three months seems too long to suspend all of a bank’s deposits. The issue portrayed by the authorities should have been solved by now (by imposing fines or any other punitive measure on the offending banks). It does not seem that punishing all depositors is the right solution to a problem for which most of them are not at fault.

Some of these banks warned their customers that they were experiencing technical problems that would be solved in a few days. These technical problems are now more than three months old. Therefore, it seems that some justifications were fabricated to simply not pay depositors.

To make matters worse, it appears that the authorities are using COVID-19 passes to block protests related to the deposit freeze. Without a COVID-19 pass, it is impossible to travel or even use public transportation, and it appears that the authorities are arbitrarily restricting the movement of depositors who intend to attend protests. Perhaps this is more in line with the government’s authoritarian philosophy than anything else.

How Significant Is the Problem?

It is estimated that between four hundred thousand and one million depositors have had their accounts frozen. The frozen deposits are worth ten billion yuan, equivalent to $1.5 billion.

Is this a lot of money? And is the freeze an insurmountable problem?

Overall deposits total $37.4 trillion. Given the immense size of the banking sector, the amount of frozen deposits is relatively small. Only 0.04 percent of total deposits have been frozen. If the deposit freeze does not worsen, it will not pose a problem for financial and monetary stability.

The problem, of course, is that this deposit freeze could be the tip of the iceberg.

The Main Cause: The Housing Bubble Burst

Why might China’s financial problems be on the rise? The main reason is that the huge housing bubble in China is bursting.

In another article, I wrote about the indicators pointing to a bubble. The purpose of this article is to point to new indications that the bubble is bursting and then analyze the impact of this bursting on the financial sector.

How do we know the bubble is bursting?

A clear sign that things are not going well in the real estate sector is that multiple housing developers have gone bankrupt. And many Chinese real estate developers are gigantic. The famous Evergrande has no less than sixteen times the assets of the largest US real estate developer, even though the US economy is larger than the Chinese economy. So far, twenty-six developers have gone officially or technically bankrupt.

Why are Chinese developers going bankrupt?

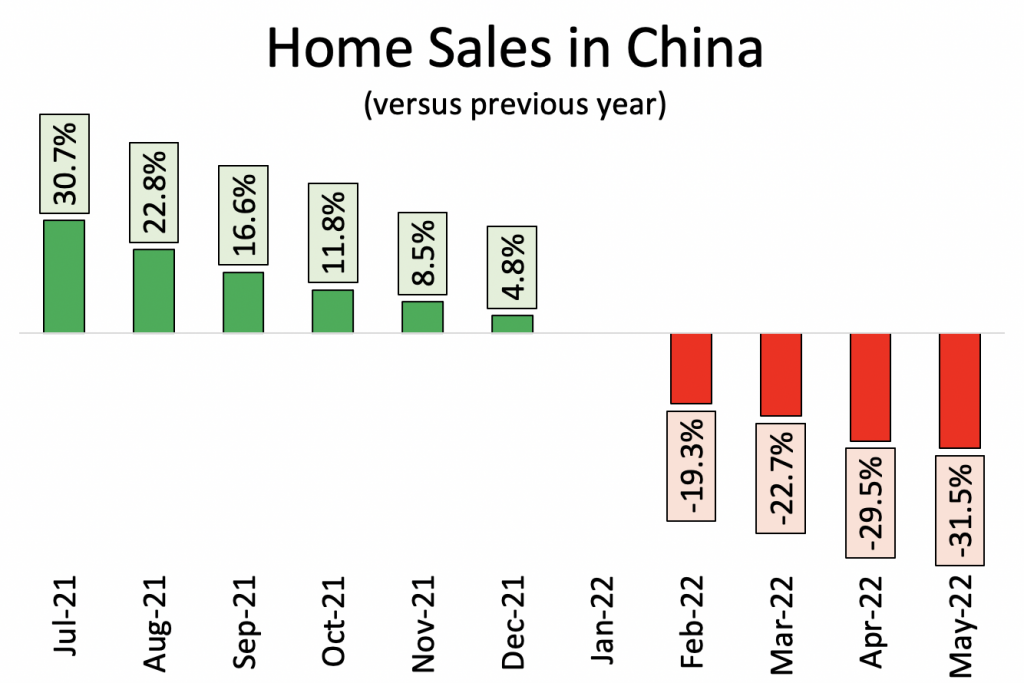

Home Sales Are Plummeting

First, home sales have plummeted in recent months.

Source: stats.gov.cn. Year-on-year change is calculated on the basis of cumulative sales for each year from January to the month in which the data are reported.

I chose July 2021 as the starting point in the above figure to prevent the effect of COVID-19 in 2020 from skewing the picture. In July 2020, home sales had just recovered their prepandemic level. Thus, the period from July 2020 to July 2021 (with a 30.7 percent increase in sales) is the first in which the pandemic’s negative effect on sales is nonexistent or minimal.

Notice that sales plummeted by no less than 31.5 percent from May 2021 to May 2022. And the declines are increasing each month.

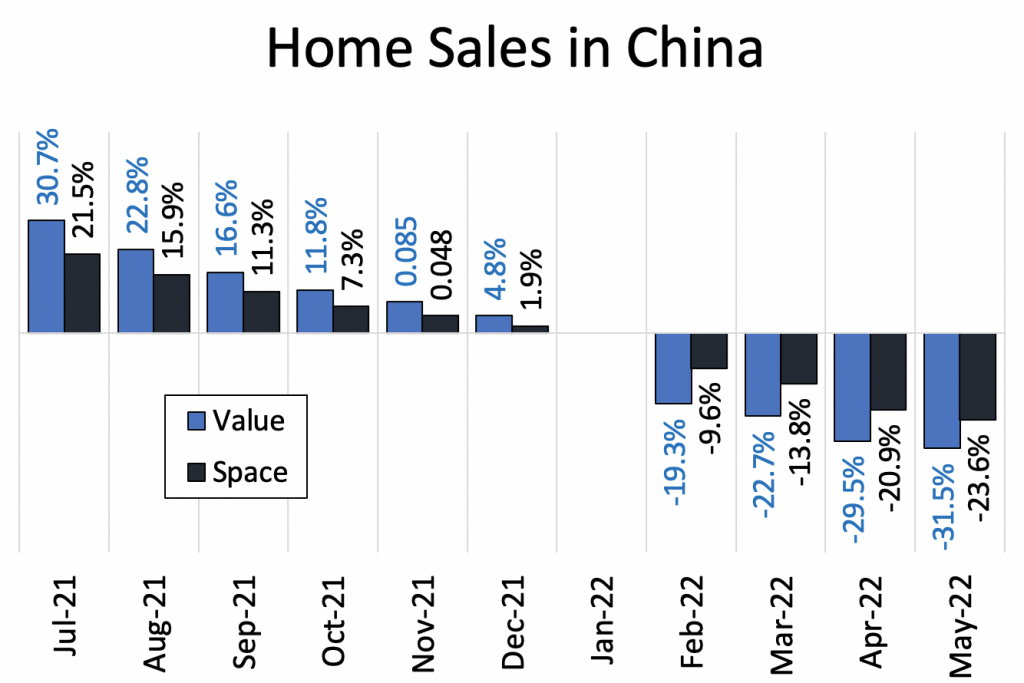

Home Sales (Value versus Space)

The drop in sales could be the result of a drop in sales volume while prices remain constant or the result of a drop in price without a drop in sales volume. Of course, it could also be a combination of the two.

If the drop in sales were due to lower housing volume while the price per square meter remained constant, it could indicate that sales have fallen because of some factor outside the real estate market such as the COVID-19 lockdowns in 2022.

In contrast, a drop in the price of housing would indicate that the housing market is suffering from inherent market dynamics.

There seems to have been a decline in housing prices.

Source: stats.gov.cn. Year-on-year change is calculated on the basis of cumulative sales for each year from January to the month in which the data are reported.

In the above figure, the same data from the previous figure (total sales) are in blue. Next to total sales, in black, is the change in square meters sold. As can be seen, square meters sold are falling sharply but not as sharply as total sales. This obviously indicates that prices are falling.

In other words, most likely, the bubble is bursting, and price falls are generating a drop in construction activity, as many real estate developments are becoming unprofitable at the lower prices.

Let us now look at construction activity rather than sales to test this hypothesis.

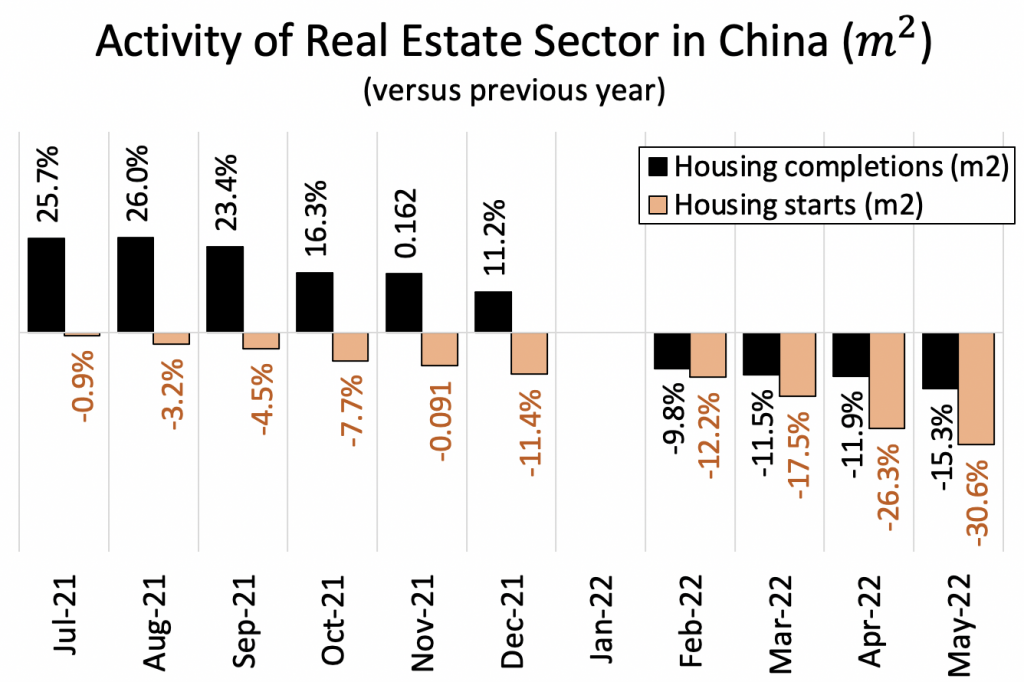

Construction Activity in the Real Estate Sector

The picture is very similar. The sharp drop in sales is indeed causing new housing development to plummet.

Source: stats.gov.cn. Year-on-year change is calculated on the basis of cumulative constructions for each year from January to the month in which the data are reported.

In the above figure, we can see that the amount of housing completions is falling sharply but the amount of housing starts is falling even more dramatically. This makes perfect sense. Housing can take several years to become available from the time construction begins, so it is clear that a significant amount of housing is half-finished in China (as is true elsewhere). The price declines have probably caught more than one developer by surprise. Many developers are stuck with projects that are likely to report losses, but they may still find it economically viable to complete them. Once a significant portion of a real estate project’s expenses have been disbursed, what matters to the developer is the expected revenues and the costs that remain to be disbursed. This is an example of the principle of sunk costs: even if a developer loses money by finishing the project, it will lose much more if it does not finish it.

This also helps us understand the scale of the bubble burst. The drop in housing starts is double the drop in housing completions; housing starts are decreasing by 30 percent on an annual basis. This tells us that many developers are losing money but are still trying to finish the projects they started. Once finished, however, they are not starting new projects.

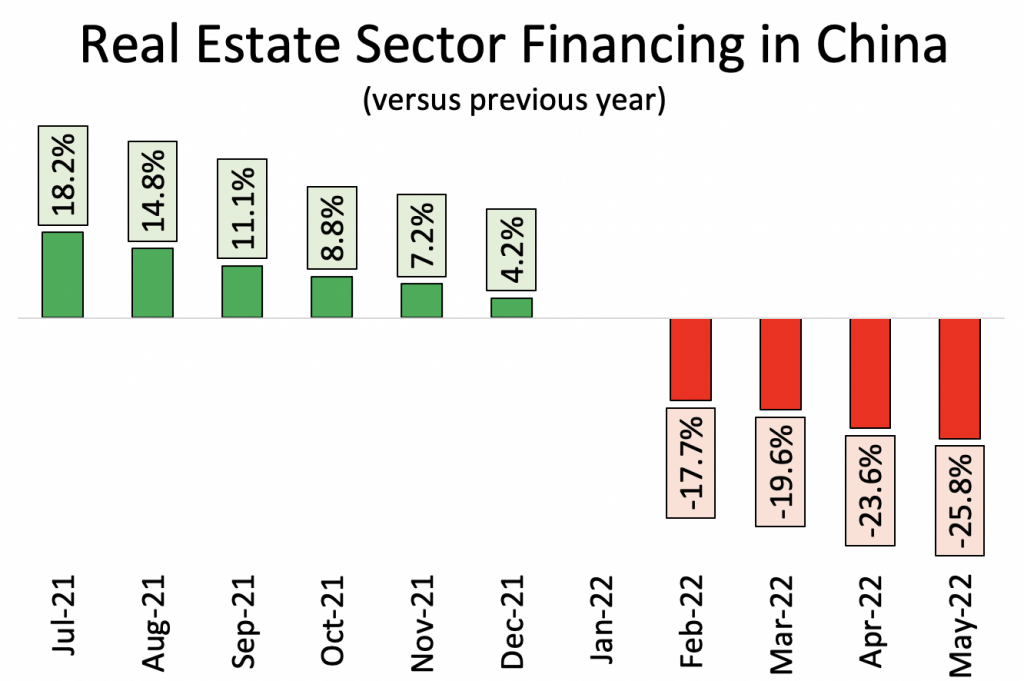

The Sector’s Financing Is Being Cut Sharply

However, the problem is even worse. The bursting of the bubble is also evident in the financing received by the real estate sector. Faced with the drop in sales and activity, many developers are going bankrupt. Faced with the wave of bankruptcies and other problems, investors in general, and the banking sector in particular, are withdrawing from the real estate market, which is cutting off funds for developers.

Source: stats.gov.cn. Year-on-year change is calculated on the basis of cumulative financing received for each year from January to the month in which the data are reported.

As can be seen in the above figure, financing received by developers has fallen steeply in recent months. The lost financing was coming from banks, the customers who buy homes with significant down payments, and the developers’ suppliers.

This may be a problem for new real estate projects that remain profitable, but the problem is far greater for all the projects that are in the process of construction.

The cut in financing is making it difficult to access resources, and this is preventing the completion of many projects. Additionally, the cut may cause the few resources available to the sector to increase sufficiently in price that it will not be feasible to complete the projects.

These problems are causing many people who started paying for housing that they have not yet received to default on their housing loans. This is where the problem for the financial sector comes in.

A social media movement is developing in which people with mortgages on homes they have not yet received are coordinating on an agreement to stop making payments. This movement may be putting banks in serious trouble.

The Impact on the Financial Sector

What is the real effect of the bubble’s bursting on the financial sector?

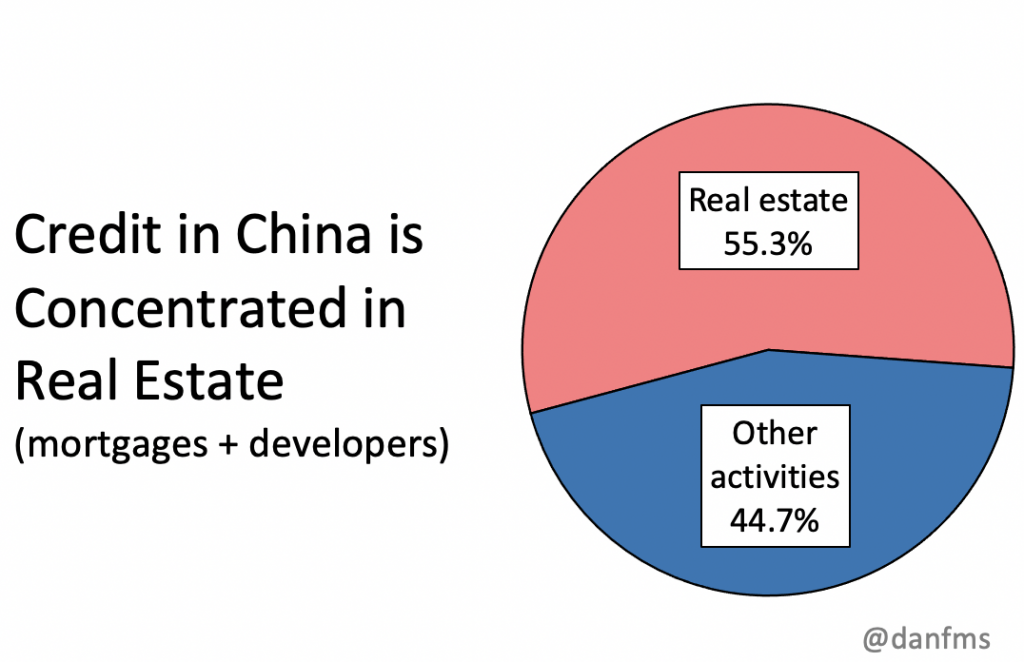

Let us first look at the financial sector’s exposure to the real estate sector.

Source: People’s Bank of China; Zerohedge; Wall Street Journal

As can be seen in the above chart, the exposure is gigantic. This exposure includes both developer debt and mortgage debt, but for every yuan of developer debt, there is ten yuan of mortgage debt. In other words, the elephant in the room is mortgage debt.

The Chinese real estate sector makes advance sales of real estate. That is, developers first sell property and later incur expenses when they start building it. This means abundant and cheap financing for developers. Meanwhile, many customers start paying their mortgages before they take possession of the property. This point is crucial to understanding the problem in the financial sector.

With the halting of dozens of real estate projects due to the developers’ bankruptcies and drop in financing, many customers who had been paying their mortgage before receiving their house have stopped paying because they have realized that they may never receive the house. According to Bloomberg, more than one hundred real estate projects in more than fifty Chinese cities have come to a halt. In just two days, the number of projects registering defaults grew from twenty-eight to one hundred.

What If China Bails Out Its Financial Sector?

It is possible that the real estate sector’s contagion effect on the financial sector will not be dramatic. China could try to save its banks as the United States and Europe did after 2008 and 2012. This rescue could be either fiscal or monetary. Both the United States and Europe undertook both types of bailout.

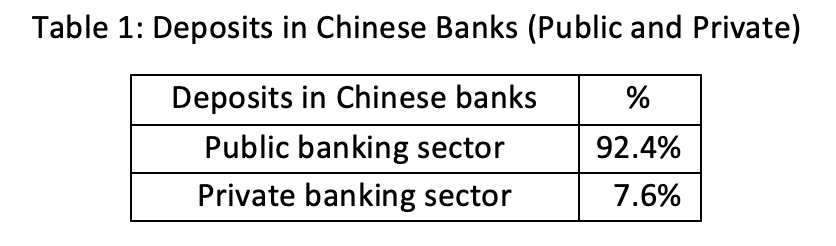

Before looking at the bailout options, however, note that almost the entire banking system is public, though it is difficult to know exactly what parts are state owned or private. I use deposit data as a proxy in table 1.

Source: People’s Bank of China

As can be seen, almost the entire sector appears to be public. Note that this does not include shadow banking, which is considerable in size.

This matters because the chance of being bailed out is much higher for a public bank than a private bank, which should reassure depositors. But not everything is rosy. As the banks are public, we have very little information on the quality of their loans. And as already mentioned, we have every reason to assume that many customers are defaulting on these loans. Still, the official figure for loan defaults is very low. It is possible that public banks have been operating with huge holes in their balance sheets for a long time because their public status enables them to operate even when bankrupt. So the potential bailout could be astronomical because much of the bad debt that these banks hold in the form of unpaid loans has not been brought to the surface. We know there is a problem, but we do not know its magnitude; possibly only a few Communist Party officials do.

First Possibility: Monetary Bailout

A monetary bailout is one of the most likely possibilities.

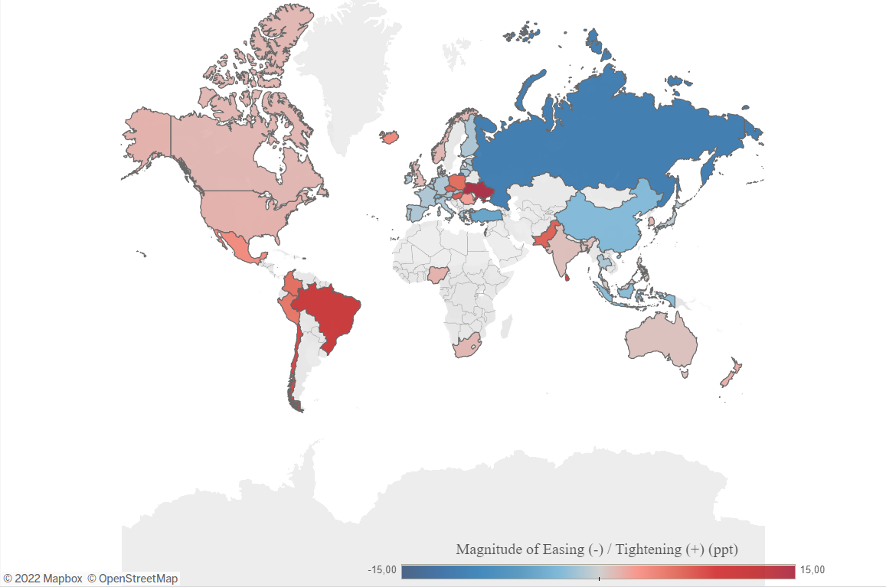

Source: Council of Foreign Relations

The above map, courtesy of the Council of Foreign Relations, shows the countries pursuing a contractionary monetary policy in red and the countries pursuing an expansionary monetary policy in blue. China is one of the few countries outside the Eurozone that is implementing an expansionary monetary policy.

That China is pursuing an expansionary monetary policy is a sign that its economy is losing steam. Expansionary monetary policy at an expansionary point in the business cycle usually results in high inflation. This has happened in most of the world’s economies in recent years, with inflation now at its highest in the last forty years. However, an expansionary monetary policy during a depression does not usually have an inflationary effect. China’s current inflation barely exceeds 2 percent a year. The picture is perfectly compatible with a recession and a bursting of the real estate bubble. In fact, even China’s official growth figures are at rock bottom, although they are not yet negative. And no one really believes the official figures.

China is pursuing an expansionary monetary policy during its recession because its financial sector is damaged. A low interest rate (that is, expansionary) policy helps to keep the price of bank-held assets from falling and allows banks to survive by simply selling assets. The problem is that if too many banks want to sell assets at once, the price of their assets will plummet. That is when the central bank steps in to buy those assets. This is called quantitative easing, a policy that has been abused for years in the West and is, quite possibly, one reason why it is suffering such high inflation. The People’s Bank of China (the central bank) has not taken this step yet.

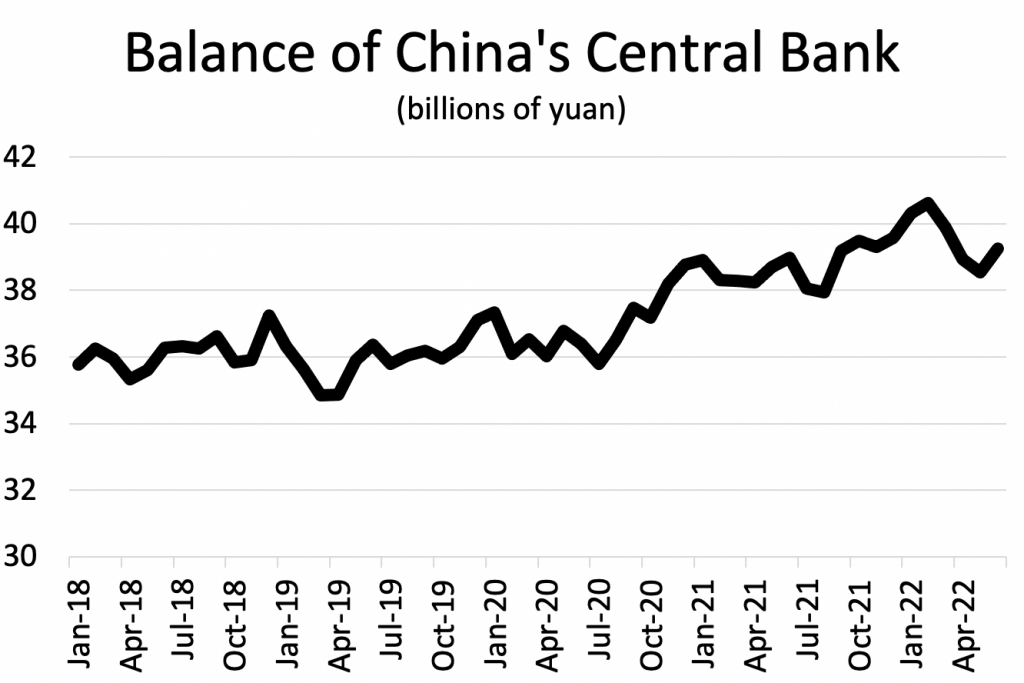

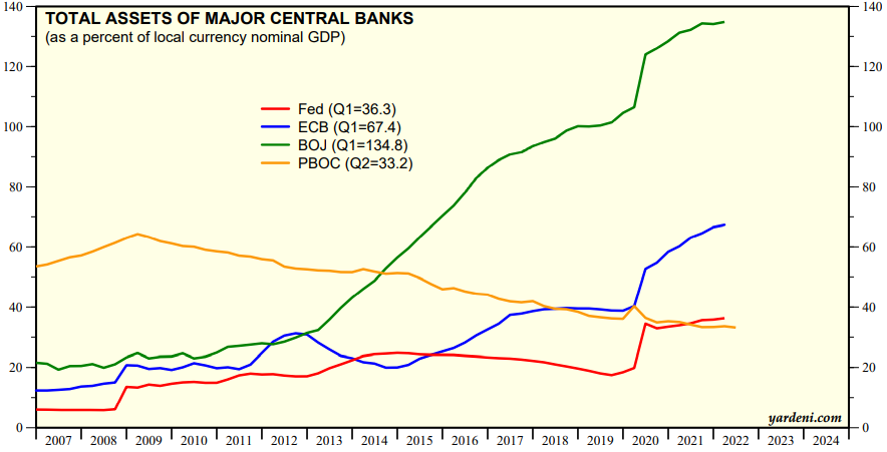

Source: People’s Bank of China

As can be seen in the above figure, the central bank’s balance sheet has grown, but so far the growth has not been dramatic. Its balance sheet is the smallest of the world’s four major central banks (the People’s Bank of China, the Fed, the European Central Bank, and the Bank of Japan) in relation to the size of their economies.

Source: Yardeni Research

Thus, it seems that China’s central bank is helping its financial sector somewhat, but it is certainly not (yet) buying the sector’s toxic assets.

Second Possibility: Fiscal Bailout

One ever-present option for recapitalizing a troubled financial sector is fiscal bailout. This is usually more politically problematic than a monetary bailout because it is much more visible. The government may be seen as giving taxpayer money to the banking sector. Fiscal bailouts are probably much less economically damaging than monetary bailouts; however, they are used less often because they are very unpopular.[1]

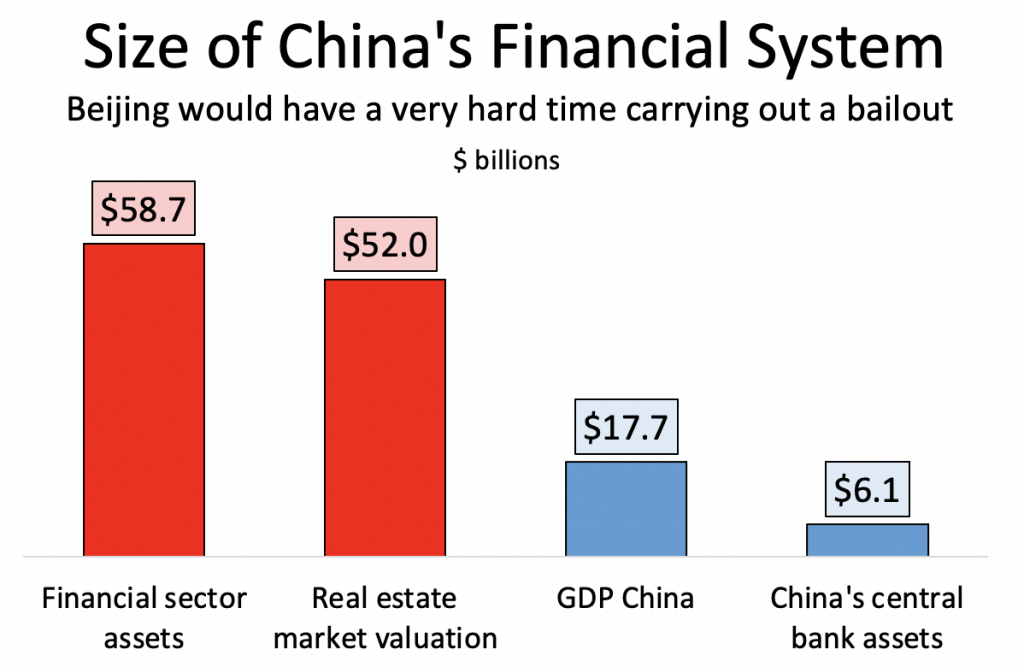

The problem with a fiscal bailout is that the financial sector is huge, and attempts to save it may be in vain.

Source: People’s Bank of China; Zerohedge; Wall Street Journal

The above figure shows the financial sector’s assets in 2022. As can be seen, the assets are about 3.3 times GDP.

For context, the total market capitalization of all US companies is $48.3 trillion. Thus, both the assets of the Chinese financial sector and the valuation of its real estate market are far higher than the value of all US companies[2] (for no good economic reason). If the problems in the Chinese financial sector are enormous, the sector cannot be rescued by the government.

The Fall in Public Revenue Due to the Bursting of the Real Estate Bubble

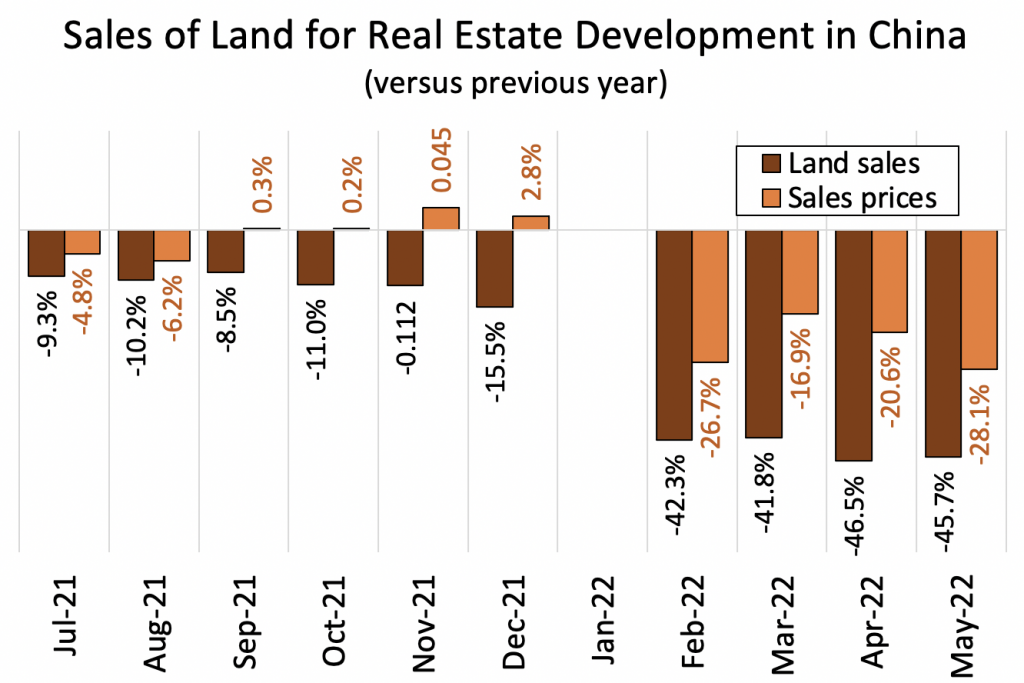

As if that were not enough, one of the preferred sources of financing for local governments in China—the sale of use rights to real estate developers—is drying up because of the bursting of the real estate bubble. This is one reason why the expansion of the real estate market over the years has kept local governments quite happy.

Source: stats.gov.cn. Year-on-year change is calculated on the basis of cumulative land sales for each year from January to the month in which the data are reported.

But the sale of land rights fell by almost half from July 2021 to May 2022, and the price of the rights plummeted by 28.1 percent. This has hit local governments’ coffers hard, so their ability to rescue a troubled banking sector is very limited.

Conclusion

In short, it is highly unlikely that the financial sector’s problems are isolated from the rest of the economy. And it seems that the sector is reaping what it sowed in its years of complicity with the real estate sector during the bubble.

When a bubble inflates, everyone from housing developers, to banks, to the authorities, to homebuyers—who see the price of their homes soar—is happy.

The problem, of course, comes when the bubble bursts. Developers go bankrupt, banks’ loans are not repaid, bank depositors anticipate losing their money if their banks fail, homeowners see their assets depreciate, and governments see their revenue fall.

What was once joy becomes all gloom. And it looks like the Chinese economy could be in for some gloomy years ahead.

Legal notice: the analysis contained in this article is the exclusive work of its author, the assertions made are not necessarily shared nor are they the official position of the Francisco Marroquín University.

–

Notes

[1] I believe that no form of financial bailout is acceptable. The only bailout should be private, through private sector capital injections or through converting bank creditors into shareholders.

[2] Total Market Value of U. S. Stock Market | Siblis Research

Get our free exclusive report on our unique methodology to predict recessions

Daniel Fernández

Daniel Fernández is the founder of UFM Market Trends and professor of economics at the Francisco Marroquín University. He holds a PhD in Applied Economics at the Rey Juan Carlos University in Madrid and was also a fellow at the Mises Institute. He holds a master in Austrian Economics the Rey Juan Carlos University and a master in Applied Economics from the University of Alcalá in Madrid.

Get our free exclusive report on our unique methodology to predict recessions