Is the U.S. Stock Market Overvalued?

By Daniel Fernández July 7, 2016

Translated from Spanish by Robert Goss

Is now a good time to invest in the stock market? This is the million-dollar question to which every investor would love to have the correct answer.

It seems as though we find ourselves in a complicated time for investing in the U.S. market for two reasons:

- Risk of recession

- Stock far too expensive

Beyond that of problems facing China, we have already addressed the risk of a recession extensively in other articles and in our reports. The risk of recession in the U.S. is slim. The risk to investors, at least in the medium term, does not stem from this.

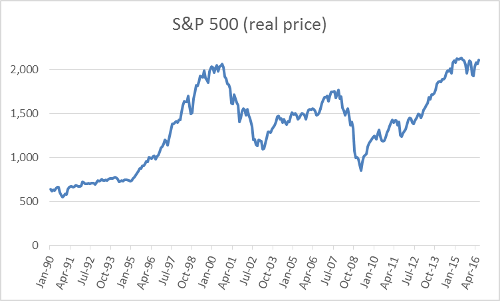

Nevertheless, a market crash could occur even without the economy entering into recession (a clear example of this would be the enormous drop in stock market prices in 1987). This is why we will attempt to respond to a second question; is the U.S. stock market overvalued? Unquestionably, since this drop and compared to the Great Recession, securities have risen a great deal in price.

Source: Stock Market Data Used in “Irrational Exuberance” Princeton University Press

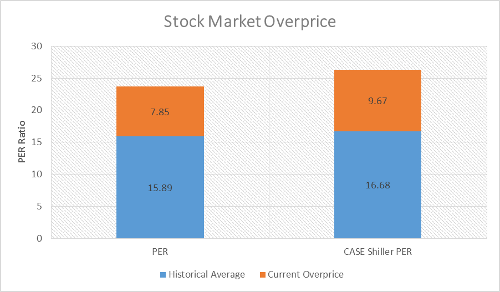

Usually, the ratio most used when measuring the overvaluation of stocks is the Price Earnings Ratio (the market price of a company share divided by the earnings per share of the company). In terms of historical returns, at present, the U.S. stock market undoubtedly is very expensive.

Source: Stock Market Data Used in “Irrational Exuberance” Princeton University Press

Historically, the P/E ratio has been at 16.7 and is currently at 26.3. This means that it would take 10 years more than average to earn on an initial investment if we buy a share today. In terms of historical yields and after discounting inflation, the U.S. market return is 7% annually. Current yields are less than 4%. This would indicate an overvaluation of stocks in the U.S. stock market.

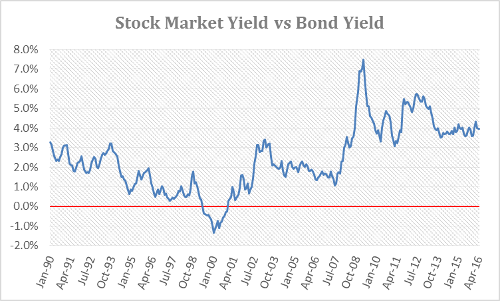

Source: Stock Market Data Used in “Irrational Exuberance” Princeton University Press

If we take a more limited time period (from 1990), we see that the current situation is not so dramatic; historical yields are at 4.2% versus a current 3.8%.

Nonetheless, in order to decide if an investment is attractive, we must compare it with its alternative, not with its own history. In this case, the most common alternative to investing in stocks tends to be fixed income investments. For this reason we propose comparing returns on stocks with returns on long-term bonds. From this point of view, the situation changes radically.

Source: Self-prepared using data obtained from Stock Market Data used in “Irrational Exuberance” Princeton University Press

With interest rates being high for bonds in the ‘90s, the inducement to investing in stocks decreases. With interest rates being low at present time, the incentive to investing in the stock market increases.

Stock yields versus yields for fixed income investments is currently at almost 4%, while historically it stands at 4.8% and, since the ‘90s, at a modest 2.4%. From this point of view, we find ourselves at one of the best times to be investing in stocks on the U.S. stock market since the early ‘90s.

It can also be noted that this result is influenced by lax monetary policies with interest rates close to 0% or even negative interest rates that are provoking a bubble in fixed income investments globally. Despite this fact, low interest rate policies also influence spikes in variable-income securities, so consequently this variable affects both types of investments.

The price of variable-income investments only seems high when we compare it to its historic average. When an alternative investment is introduced, the interpretation changes drastically. The price of the variable-income investment compared to its alternative, a fixed income investment, currently finds itself at one of its lowest point in the last 25 years.

The U.S. stock market is offering some of the best returns compared to fixed income of the last 25 years.

Get our free exclusive report on our unique methodology to predict recessions

Daniel Fernández

Daniel Fernández is the founder of UFM Market Trends and professor of economics at the Francisco Marroquín University. He holds a PhD in Applied Economics at the Rey Juan Carlos University in Madrid and was also a fellow at the Mises Institute. He holds a master in Austrian Economics the Rey Juan Carlos University and a master in Applied Economics from the University of Alcalá in Madrid.

Get our free exclusive report on our unique methodology to predict recessions