Spanish Economy Showing Strength in Light of Political Uncertainty

By Ángel Martín Oro July 10, 2016

Translated from Spanish by Robert Goss

This article is an excerpt from the quarterly report on the economy of Spain and can be found here.

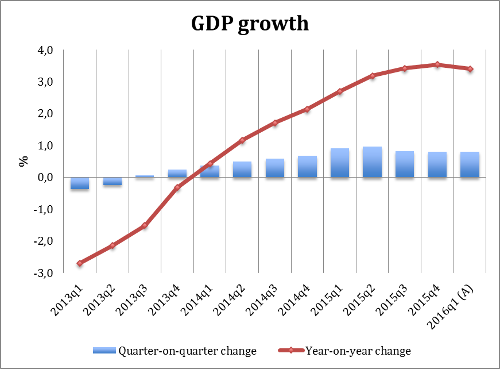

The Spanish economy maintains a drive equal to that of last year. The fears that there would be a significant slowdown as a result of political uncertainty have proven to be unfounded. Year-on-year GDP growth during the first quarter of this year was at 3.4%, only one decimal less than what it was during the last quarter of 2015. Similarly, employment remains at strong levels, as well.

Graph 1. GDP Growth

Source: INE. The last figure is INE’s Advance Estimate

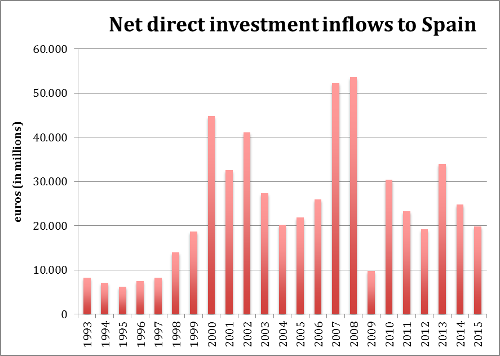

But, how has this political uncertainty impacted foreign investors’ entry into the economy of Spain? If there was ever a path for significant real consequences for which a problem of this sort arises, it is that of direct foreign investment, that which requires long-term commitments. Portfolio investors, whether they be in stock or in bonds, have the capability of doing short and long term selling and buying, but for the case of direct investment, the commitment is one of longer term.

In order to deduce whether or not it really is the case that investors are fleeing Spain, in our first quarter report, we have depicted net inflow by direct investment.

Graph 2: Net Inflow by Direct Investment in Spain

Source: Bank of Spain

We see here that had there existed more certainty, 2015 most likely would have closed with greater figures from direct investment, given the positive momentum seen in the Spanish economy.

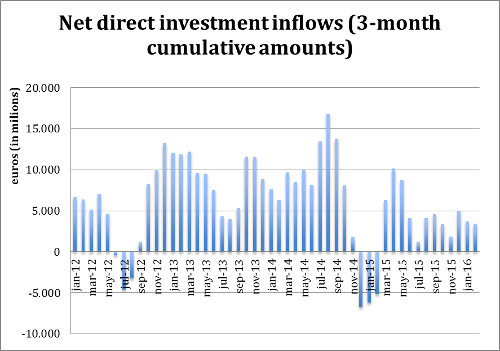

When broken down into only the last three months, we see a recent drop in net inflow but far from cause for alarm.

Graph 3. Net inflow by Direct Investment in Spain (last 3 months cumulative)

Source: Bank of Spain

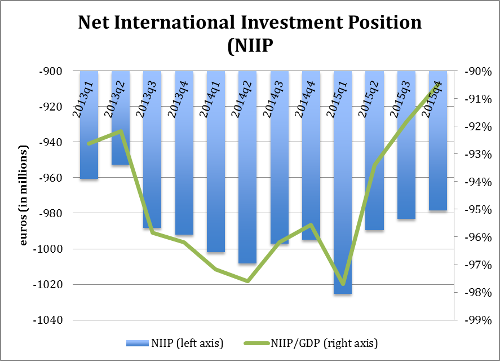

In the fourth quarter of 2015, Spain’s account balance registered a 31.3 billion euro rise in net foreign assets (cash outflow for the funding of foreign projects) when compared to a decrease of 22.2 billion euros during the fourth quarter of the year before.

These figures have been interpreted by many as a reflection of a significant flight of capital. This interpretation, however, is erroneous. Net outflows for funding reasons, a far cry from being equivalent to the fleeing of foreign investment due to fears, is a symptom of a healthy foreign debt reduction process, which, as we demonstrate in graph 4, is occurring at a very modest and gradual pace.

Graph 4. Net International Investment Position (NIIP)

Source: Bank of Spain. Left axis: NIIP in millions of euros

Meanwhile, the case for the Bank of Spain has been the opposite, playing a pertinent role. The NIIP of the Bank of Spain, compared to the Eurosystem, registered inflows for 23 billion euros (negative balance) compared to outflows of 26 billion in the fourth quarter of 2014. These figures were generated by the European Central Banks’s asset purchase programme.

Clearly, the economic impact experienced from political uncertainty is not as great as had been feared. At the same time, it should also be noted that these figures are incapable of showing us what would have happened had the political landscape been more certain.

More details about the Spanish economy can be found in the 2016 first quarter report by UFM Market Trends.

Get our free exclusive report on our unique methodology to predict recessions

Ángel Martín Oro

Ángel Martín Oro is VP of Spain at UFM Market Trends in collaboration with Instituto Juan de Mariana. He is also a PhD-candidate in economics. He is also a senior consultant at iDen Global and was previously an editor at the financial portal inBestia.com. In addition, he is a professor of the OMMA Master of Economics. He is the author and co-author of numerous reports and articles, published in Spanish and international media, such as the Wall Street Journal and the Cato Institute.

Get our free exclusive report on our unique methodology to predict recessions