Spain Once Again Overshoots Budget Deficit Target for 2015

By Ángel Martín Oro May 16, 2016

Translated from Spanish by Robert Goss

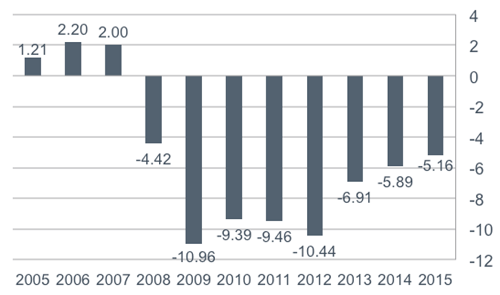

What all of us already knew has now been confirmed: the Spanish government body came far from achieving the budget deficit goal for the close of 2015. Final figure have come in at 5.16% of GDP, compared to the 4.2% that they had promised to Brussels.

According to recent publications in Cuentas Trimestrales no Financieras de los Sectores Institucionales del cuarto trimestre de 2015, the public sector presented a need for 56.608 million euros in funding (compared to 62.319 million in 2014). This slight is due mostly to the rise in revenues as a result of growth in GDP, which in 2015 was at 3.2%.

In our last UFM Market Trends report on Spain for the second half of 2015, we had predicted that figures for the close of the year would not be good. We reported the following:

“The reduction rate (in the budget deficit) continues to be inadequate. Assuming that for the close of 2015, a year-on-year growth rate in revenues and spending is equal to that of January to September, the budget deficit would close at 5.15% in 2015.”

This proved to be the case, give or take a point.

To put things into perspective regarding developments of the deficit over time, let’s take a look at the following graph in terms of GDP:

Current figures are far from those seen in 2005-2007 where Spain registered surpluses in its public accounts. The problem was that these surpluses were being sustained by inflated revenues and the economic boom from the credit and real estate bubbles. That all changed in 2007 when these revenues collapsed and spending increased as a result of the crisis (spending on unemployment or higher interest on debt) and the policies of spending incentives (Plan E).

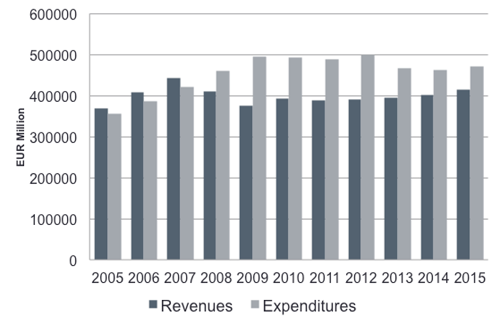

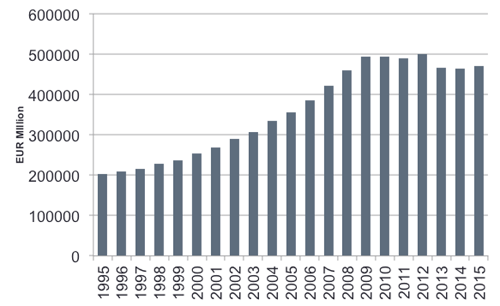

Despite what is commonly said to be the case, the adjustments made to the deficit have been modest. The actions taken by the poorly named “austerity” measure have had a larger burden on the private sector, by means of increases in taxes, than on the public sector. The following graph of public spending in Spain offers a good perspective:

The notable deviation in the deficit shows the perspective in which it becomes absolutely necessary to examine the measures taken in the adjustment of the deficit, where it would be preferable to concentrate more on cuts in spending. This will not be enough, even with a powerful boost in the Spanish economy.

But in the context of policy uncertainty, urgent measures taken in adjustments can get complicated, especially considering that none of the political parties have given much priority to reducing the déficit.

In the next UFM Market Trends report on Spain, we will delve more into the most important matters confronting the situation of the Spanish economy.

Get our free exclusive report on our unique methodology to predict recessions

Ángel Martín Oro

Ángel Martín Oro is VP of Spain at UFM Market Trends in collaboration with Instituto Juan de Mariana. He is also a PhD-candidate in economics. He is also a senior consultant at iDen Global and was previously an editor at the financial portal inBestia.com. In addition, he is a professor of the OMMA Master of Economics. He is the author and co-author of numerous reports and articles, published in Spanish and international media, such as the Wall Street Journal and the Cato Institute.

Get our free exclusive report on our unique methodology to predict recessions