Japan and the Myth of Currency Depreciation and Exports

By Edgar Ortiz July 27, 2015

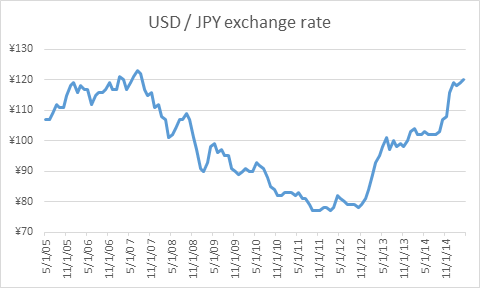

In The Yen’s Depreciation, we examined why the yen has depreciated against other currencies. We looked at the USD/JPY exchange rate over the past few years and found that the yen has been losing value against the US dollar since April 2013, when Japan launched quantitative easing (QE).

In short, we pointed out that the depreciation of the yen was due to an increase in the monetary supply in Japan. This increased supply made it less profitable to hold the currency, and as a result, market participants increased their short positions on the yen against a backdrop of increasing dollar strength.

Many believe that currency depreciation will stimulate exports because a cheaper yen will supposedly provide Japanese goods with a competitive advantage. We have several observations related to this widespread belief.

First of all, the depreciation of a country’s currency has a deglobalizing effect for any economy. In a modern economy where there’s a wide and extensive division of labor, all countries depend on other countries, either to acquire finished goods or to acquire the raw materials needed to produce finished goods for domestic consumption or exports. A “cheap” currency will increase the price of imported raw materials, which in turn generates additional costs for local producers.

On the other hand, empirical evidence does not suggest that the exchange rate is a determining factor for the success of a country’s exports. Rather, the challenge for businesses is to offer goods and services demanded by consumers at attractive prices. Just consider how eurozone exports grew from 2011 to the first quarter of 2014, a period in which the euro appreciated significantly against the dollar.[1]

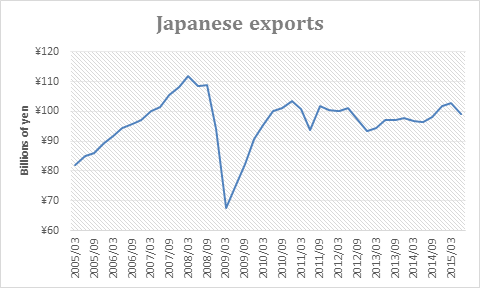

Remember that between 2011 and 2014, the United States was in the process of executing QE programs which weakened the dollar against the euro and other important currencies. The same is true for Japan, as seen in the graphs below.

Except for a period between the end of 2008 and 2009, when the global economic crisis was felt in Japan, exports remained at relatively strong levels between 2011 and 2014. If we look at the exchange rate during this period, we find that those export levels were posted in an environment in which the yen was “expensive” against the dollar compared to the current exchange rate.

The increased pace of exports between 2005 and 2007 may be attributed to the economic boom prior to the crisis of 2008 and not to the yen exchange rate, which was at levels similar to the current one. Instead, Japan clearly experienced growth in exports in a post-crisis context with a “strong” yen and a global economy much less heated than in years prior to the crisis. So it seems that Abenomics is not an effective way to reactivate Japanese exports. We believe there are various other elements of the Japanese economy that must be examined, especially public debt levels. Japan has one of the highest debt-to-GDP ratios, and the IMF has already issued warnings and recommendations regarding the country’s “unsustainable” debt levels

[1]. See UFM Market Trends Eurozone Report, January–March, 2015, p. 19.

https://trends.ufm.edu/en/newsletter/

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions