Is the United States in a Real Economic Recovery?

By Clynton R. López F. April 6, 2015

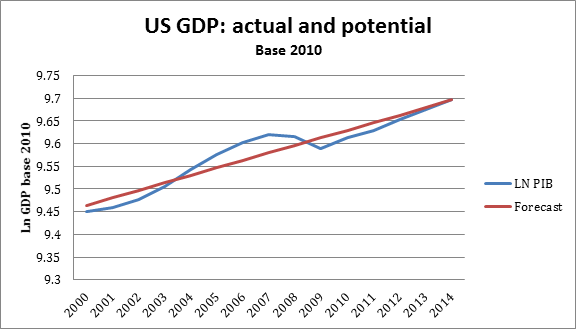

When talking about economic recovery, a distinction must be made between short-term and long-term effects. We’ll label as short-term effects those that last less than a year, and as mid and long term those that last more than a year. In practice, three to five years are needed to determine if effects are long lasting or not. The chart below shows the long-term trend GDP, or potential GDP, over the past fifteen years. The difference between the potential GDP line (forecast) and the actual GDP line (LN GDP) is the output gap. From 2007 to 2009, actual GDP fell and broke below potential GDP. However, from 2009 to 2014, the output gap narrowed. The question is, is this a bubble like 2001 and 2007–2008 or is it a real recovery?

A real recovery would imply that in 2007–2008 there had been a liquidation of overinvestments or investments made with an intertemporal mismatch in the expectations of consumers and producers. It’s important to note that the US financial system reported overall credit growth (banking, commercial, industrial, mortgage, and consumer credit) of 12.8% from January 2014 to January 2015. On the other hand, bank funding (demand deposits, time deposits, and loans to banks) has only grown by 7.2% over the same period. Without considerable increases in funds provided to the financial system by the Federal Reserve, there would seem to be only one explanation: accelerated lending activity.[1] This is apparently confirmed by the House Price Index from the Federal Housing Financing Agency, which shows that by January 2015 home prices had recovered to levels last seen in 2007 (pre-crisis). But to have further support, we must understand what households and businesses are doing in the American economy. The Federal Reserve’s Flow of Funds report (with 3Q 2013 data) indicates that household mortgage debt growth is positive for the first time since 2009, and consumer debt is growing at rates above 4%, which has not been seen since 2011. At the same time, a reduction in household financial assets has been occurring since 2013. It is important to note that over this same period state and local government debt has declined, although that is not the case for federal government debt. Businesses have significantly increased their debt over the last year, while at the same time reducing their holdings of financial assets. The most important expenditure for businesses in the third quarter of 2013 was capital investments, of which 92% were nonresidential assets, or in other words, productive assets. These are interesting events that have taken place in the United States recently.

From a practical perspective, a five-year growth period to close the output gap seems like a genuine economic recovery. A close look into the behavior of households, businesses, and nonfinancial corporations shows that there is optimism that a real recovery is taking place, driven by clear growth drivers: increasing capital investments, declining financial asset holdings by businesses, and accelerating growth in consumer credit and to a lesser extent in mortgage financing. Another question arises: Will business expectations that drive current investments match household expectations on future consumption? Only time will tell. In our next edition we’ll return with a theory that attempts to answer the question, is there real economic growth in the United States or is it another bubble? We’ll analyze the FED’s behavior and interest rates.

[1]. Funds resulting from an increase in the residual account (assets – liabilities, but without affecting the accounting for capital requirements) of 7%.

Get our free exclusive report on our unique methodology to predict recessions

Clynton López

Clynton López is a professor at the Francisco Marroquín University since 2002 in the areas of economics and philosophy. He has a degree in Economics with a specialization in Finance from the Francisco Marroquín University and a master in Economics from the same university, both Magna Cum Laude. He studied executive programs at Boston University on Managerial Economics & Corporate Finance, the Master of Philosophy at the Rafael Landívar University (specialization in phenomenology), and the Post Graduate Degree in INCAE for Senior Management. In the professional field he has more than 10 years of management experience in banking and financial companies in Guatemala, California and Puerto Rico, and is a member of the Mont Pelerin Society.

Get our free exclusive report on our unique methodology to predict recessions