Facebook’s New Cryptocurrency and Its Problem with Authorities

Facebook’s Libra Should Embrace Being Classified as a Bank — a Better Kind of Bank

When I first read that American and British authorities stated that Facebook’s Libra would have to operate as a bank [1][2], I immediately thought, “Regulators are always in the way of innovation.” Now, after taking not only a closer look at the project, but also a very deep look into the monetary principles that economic theory establishes, I assert that Facebook must understand (if it wants to be successful) that it cannot escape being branded as a financial intermediary as it is in fact aspiring to “create money.” Although the Libra Blockchain has the potential to be a groundbreaking open-source infrastructure to declare and handle digital financial assets, the mere administration of the Libra currency (and reserve) should be embraced by everyone as faster banking at a higher level of abstraction.

If It Is Money for You, Is It Also Money for Facebook?

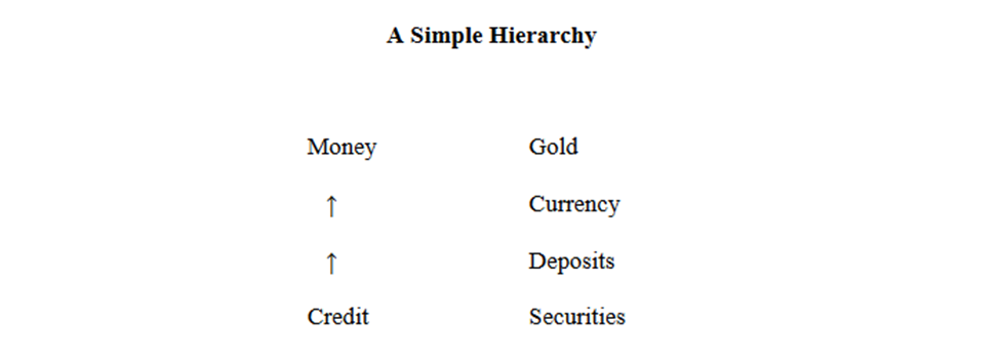

What is money for you is not necessarily money for Facebook, and it is not in this case. The Libra currency will be a promise to pay money. But, as Perry Mehrling used to say in his novel explanation of the hierarchy of money, whether an asset is “money” depends on the economic agent that we are analyzing. In the 1800s, under the gold standard, a dollar bill or a British pound note promised to pay a specific amount of gold. That did not mean that the dollar bill itself and the British pound note itself were not “real” money, but it did mean that such bills were liabilities from the perspective of the central banks.

What looks like money at a given level of the hierarchy may look like a promise to pay from the standpoint of higher levels. Source: The Inherent Hierarchy of Money by Perry Mehrling.

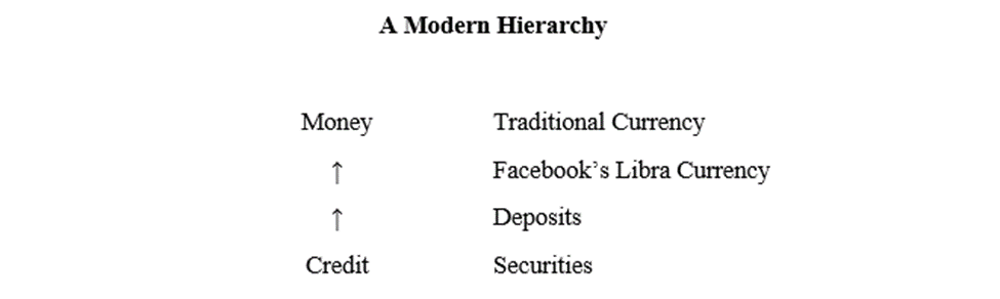

The bills were “real” money for the average user then as much as today because they served as an effective and highly liquid medium of exchange, were a safe store of value, and performed as a unit of account for economic calculation when needed. They were also excellent money because they were backed by gold. Gold, meanwhile, became money because it was highly durable (essentially indestructible), easily transportable, very malleable (which makes it very divisible), easily verifiable, and relatively scarce. The “money-ness” of an asset is what makes it great money. At the digital level, from the perspective of its users, Facebook’s Libra has the exciting prospect of achieving the function of money and possesses excellent properties through its fast and reliable infrastructure of enduring promises to pay (other kinds of) money on demand to its holders. The Libra currency will never pay out gold, but its effectiveness must be judged in light of the fact that it is a promise to pay as a medium of exchange. Similar to a bank that promises to pay money on demand in the form of bank deposits that can also be used to make electronic transfers, the Libra currency will work just like that on a higher (and far more flexible level of abstraction with several other currencies.

Source: Own elaboration.

Although demand deposits may feel less like money than currency does, they may still function as a medium of exchange. Let us emphasize that they are not currency; they are promises to pay currency. If Libra resembles demand deposits, it is because it will account for promises to pay traditional currency from the Libra reserve. But if we call Libra a “currency,” it is because it will be an incredibly effective medium of exchange (even tradable in the exchange market against other currencies). To users, it will feel like currency when needed.

To be precise, however, Libra is not only Facebook’s. Facebook is a partner in the larger and independent Libra association, and the association really does not intend to be a bank — or it is trying hard not to be. According to its white paper, a core belief of the organization is “that a global currency and financial infrastructure should be designed and governed as a public good.” [3] It is an inspiring proposition, but I question the thoughtfulness and precision of such a characterization given the intrinsic nature of what Libra is trying to do.

Financial Intermediation Is as Good as What It Is Behind the Scene: The Libra Reserve

Because the Libra association understands that “people need to have confidence that they can use Libra and that its value will remain relatively stable over time,” in the real world, the Libra currency is set to be “backed by a reserve of real assets designed to give it intrinsic value.” [4] For every Libra that is created, a decentralized basket of bank deposits of traditional currencies and short-term government securities (from “reputable” central banks) will be held. The Libra association intends to use the short-term interest on the reserve assets to “cover the costs of the system, ensure low transaction fees, and support further growth adoption.” [5] The Libra association claims to be not-for-profit. Users of Libra should not expect to receive a return from the reserve. Such activities are reminiscent of the financial proceedings behind commercial banking (regardless of the difference in the enterprises’ motive).

But, unlike most financial intermediaries that seek to (explicitly) maximize profit, the Libra enterprise has unique motivations to match its cash flows — that is, it tends to invest in assets with a term similar to that of its liabilities, which is understood to be short. Supposing that going with a not-for-profit scheme is not enough to ensure the cash flows match, one could still argue the enterprise has to keep the reserve liquid in order to keep its currency liquid — a good quality for a global currency. Though it is still banking, it is banking with novel ambitions and different priorities. I am not ignoring the fact that, historically, commercial banks also have sought to keep their investments aligned with the timing of their obligations out of fear of sudden withdrawals of deposits — bank runs. Staying liquid is not a new idea, yet going illiquid is nowadays common in the banking system. The question is whether Libra will be able to avoid the temptation to invest long term while borrowing short as today’s banking system does.

The association goes so far as to claim that, in terms of liquidity, it plans to rely on “short-dated securities issued by these governments, that are all traded in liquid markets that regularly accommodate daily trading volume in the tens or even hundreds of billions.” [6] It explains that doing so “allows the size of the reserve to be easily adjusted as the number of Libra in circulation expands or contracts.” As discussed in the official Libra Reserve white paper, the basket has been structured with capital preservation and liquidity in mind. The administration of the reserve is what gives form to the financial asset beyond the technological stack, and this same feature is what has the association on the verge of being classified as a bank — as uncommon or innovative as it may be. Unlike with other cryptocurrencies, the administration of such a currency would play a role in financial intermediation. It will be the kind of money that is a “contractual” obligation from the perspective of the issuer — that is, a liability.

In other words, the Libra currency is one thing, and the technology that implements it is another. The part that resembles banking is the financial intermediation that manages the Libra reserve so that the Libra currency can work as a financial asset. The role of the Libra association regarding the engineering of the Libra Blockchain is another matter.

The Libra Currency Illustrates the Libra Blockchain’s Potential

Libra’s mission has two components: (1) a simple global currency and (2) a financial infrastructure that empowers billions of people. This nuance is of utmost importance. The Libra currency will be built on the Libra Blockchain, which is open-source software that any individual can contribute to after signing a Contributor License Agreement with a free GitHub account.

The Libra Blockchain is a new blockchain. The word “blockchain” hints at the data structure that lies behind the technology of cryptocurrencies. The trick is to hold a decentralized database of distributed blocks where the operations to edit information must go through the appropriate blocks and satisfy the right protocols. This technology is the key to achieve a public record of irrefutable information, which in finance is the means to implement an accounting registry that guarantees the security of decentralized operations with digital money — that is, a distributed “ledger.” As Michael Casey, co-author of The Truth Machine, puts it, it is a new method of “shared record-keeping.” Thus, Libra intends to inherit all the good properties of blockchain technology to meet the daily financial needs of billions of people. These good properties include efficiency in storage and throughput, scalability, and security. But Libra has a clear vision for how to be adaptable in the future to encourage disruptive financial innovation. This vision has led to the implementation of a powerful new programming language called Move that has been designed from the ground up with safety and security as the highest priorities.

Move was designed to build and use the Libra Blockchain. Unlike other popular blockchain software (e.g., Bitcoin Script, Ethereum Virtual Machine), Move’s key feature is the ability to effortlessly define digital resources that share the same properties as physical assets — that is, “a resource has a single owner, it can only be spent once, and the creation of new resources is restricted.” [7] Such a feature is not trivial: it is a vital part of what makes the technology that powers Libra more significant than Libra itself. From the get-go, the infrastructure has been designed to enable an ecosystem of independent developers to implement digital assets like the LibraCoin if they want to. In principle, there is no reason why developers cannot declare and administrate digital assets with more interesting financial properties than the LibraCoin resource type.

Example script of Libra Blockchain’s Move programming language declaring a resource type

Source: Move – A Language With Programmable Resources. Example script of a Move’s module. It exemplifies the graceful simplicity with which any developer can declare a resource type, and still be guaranteed to enjoy the same resource safety properties as the LibraCoin – i.e., module authors have “complete control over the access, creation, and destruction of their declared resources.” Such resource safety prohibits “strangers” from copying, destroying, or double-moving resources – i.e., independent developers would only be able to perform the “move” operation on the official LibraCoin type, as they did not declare it.

In other words, the technology has the potential to empower an ecosystem of developers that can declare and handle safe digital assets as good as the Libra currency at a software level. What is left for independent developers is to design financial innovations that give the digital assets the characteristics that would make them excellent financial assets.

Conclusion

The point of this article is not that most of today’s regulations on “normal” banks would necessarily fit the new technology (and financial intermediation) right away (although they surely would fit more easily with appropriate characterizations of the project). The main thesis is that it is impossible to escape the economic nature that revolves around adopting the use of promises to pay (liabilities) as a means of exchange. The core of banking, since its very beginning in human history, is the promise of paying currency to depositors on demand. Libra may not sound like modern banking, but it still fits in the hierarchy of money. Facebook’s Libra is not in conflict with any other currency, because it is a useful promise to pay other currencies rather than a comparable currency of today’s world itself. From the perspective that concerns central banks and regulators, it would be built on top of the rest, not on the side. Mark Zuckerberg would provide Libra with a better defense if he explained that it is a form of banking that makes it easier to engage in international transactions thanks to its decentralized global infrastructure. It is a cryptocurrency that represents a basket of traditional currencies. In brief, Libra is a form of banking that is much faster and more flexible than traditional banking and does not carry the risk of depreciation or changes in value that other cryptocurrencies do.

–

[1] In July of 2019, Donald Trump tweeted that “(…) if Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations, just like other Banks, both National and International.”

[2] According to a note from Reuters, the Bank of England’s FPC said that Libra would have to abide by “(…) existing supervisory ‘tools,’ rather than [the Bank of England] resorting to new rules.”

[3] See the Introduction section of the official Libra white paper.

[4] See Introducing Libra section of the official Libra white paper.

[5] See The Libra Currency and Reserve section of the official Libra white paper.

[6] See ‘What are the actual assets that will be backing each Libra coin?’ section of official Libra Reserve white paper.

[7] See Move’s official white paper: “Move: A Language With Programmable Resources.” You may also refer to Move’s official documentation directly at developers.libra.org.

Get our free exclusive report on our unique methodology to predict recessions

José Alvarez

José is a Computational Sciences major at Minerva University (San Francisco, CA) with a concentration in Mathematics. Previously, he has been awarded first place at the Facebook 2019 Data Challenge (Menlo Park, CA), and taken part in UElCato from the Cato Institute and Francisco Marroquín University (Guatemala City). He is also seeking a minor in Government, Politics, and Society at Minerva.

Get our free exclusive report on our unique methodology to predict recessions