Economic growth in Japan decelerates (again)

By Edgar Ortiz Romero August, 24 2015

Translated from Spanish by Andrés Contreras

The main topic of discussion about the Japanese economy over the last twenty years has been its deflation and low economic growth. Japan’s last big economic policy bet has been its quantitative easing (QE) program launched in April 2014.

This measure, also known as Abenomics for its association with Prime Minister Shinzo Abe, has apparently not been enough to put the Japanese economy back on the right track. In two prior articles we have discussed the effects of this policy on the Yen.

First, in June we referred to the increase in short positions or bets against the Yen, which have further weakened the Yen with respect to other major currencies. Second, in July we said that depreciation of the Yen is not the way out for a country that exports value added products and that it makes the production chain more expensive by raising the cost of intermediate goods that are imported to make final products.

Now we see that Japan’s real GDP has declined by 0.4% with respect to the prior quarter. A low figure, but not at the levels seen in the same quarter of 2014.

Source: Bloomberg

Abenomics also has a fiscal stimulus component which has led the Japanese government to accumulate high levels of debt relative to its revenues. Despite the objective set for the fiscal stimulus, it has not had a sustained effect on GDP.

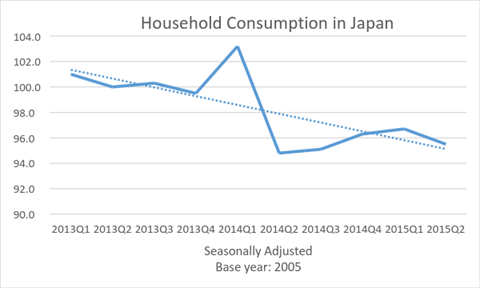

Something similar is seen in the behavior of household consumption. There was a slight increase in consumption towards the end of 2013 when the monetary stimulus package was initiated, but then it has fallen since 2014.

Source: e-stat.gob.jp

It’s relevant to ask at this point if the problem in Japan is monetary or if it’s due to more structural issues. At this juncture, it’s far from clear that Abenomics has ignited the spark on consumption.

In fact, we should start questioning the cost-benefit of this monetary policy. It’s well known that the population pyramid in Japan generates big challenges for pension funding. The country’s birth rate is in constant decline and the longevity of the Japanese people is an undeniable fact.

The Japanese government has increased public spending, raising public debt to GDP to nearly 232%. We should question if today’s short-term stimulus could put Japan’s public finances in serious trouble over the medium term.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions