The Devastating Effects of Monetary Policy on Investment and Capital Markets

The next recession will hit the world’s major economies in an environment with interest rates that are close to zero or even negative. Two of the three reserve currencies (the euro and yen) have nominal interest rates around 0 percent. However, if we take inflation into account, their real interest rates are actually below 0 percent. The Federal Reserve will probably fix rates at around 0 percent as soon as there is evidence of the next recession, which does not seem to be far away.

Quantitative easing (QE) policies have become less and less effective for a number of reasons, among which we highlight the following:

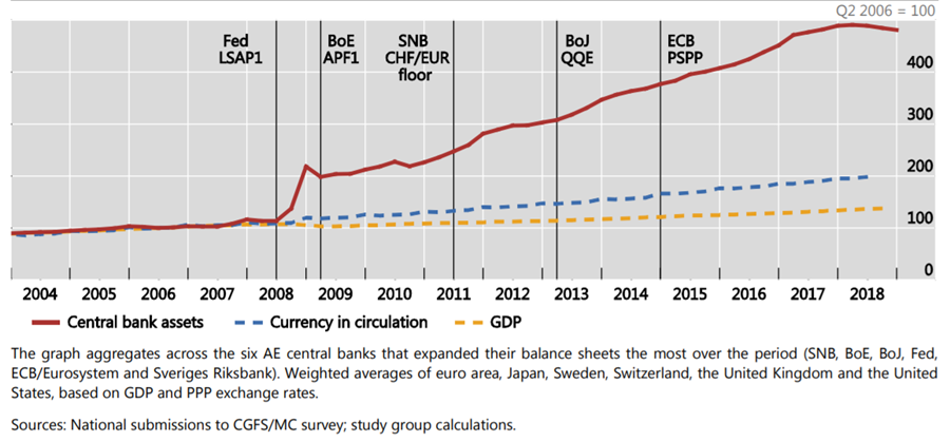

- There is limited additional scope for new QE programs because central banks have greatly increased bank balances in the past. Banks are now incapable of reducing these balances without provoking panic in the market, so additional injections of liquidity have a much more limited ability to boost the economy. However, these liquidity injections have contributed to to financial-asset price increases, in many cases distorting prices relative to their intrinsic value.

Chart 1 – Central Bank’s Assets Evolution

- QE has seriously distorted the yields, differentials, and risk perceptions of economic agents. Returns on bonds have been decreasing for more than a decade and are currently at an unprecedented low level. The relationship between bond returns and the credit quality of businesses and countries is becoming less and less direct. The Bloomberg Barclays US Corporate High Yield Total Return fund, which includes the corporate fixed-income issues with the highest risk in the United States, has seen its yield to fall from 9.06 percent (December 2009) to 5.19 percent (December 2019). In normal circumstances, only the most solvent companies are able to borrow at such low yields. The longer this trend continues, the greater the price distortion of all financial assets. This will cause investors to move toward higher-risk assets in their quest for higher returns, which in turn will increase prices and risks even more.

- Near-zero interest rates in Japan and Europe have destroyed the intermediation margins of banks, which serve as connections between savers and investors. The EURO STOXX Banks Index has been falling for a decade, falling from 220 in 2009 to 96 currently. This is far from the record high of 464 in 2007.

- Near-zero interest rates have also caused the wealth of financial-asset owners to increase while the value of the savings of those without financial assets (whose savings are eaten up by inflation) declines. This divergence is known as financial repression. More specifically, if bank margins decrease, so too will the interest they pay to their depositors. These depositors will see their savings decrease in real terms as inflation gradually erodes their wealth. And extraordinarily low interest rates also drive up the price of financial assets, thereby increasing the wealth of asset owners.

This negative externality of expansionary monetary policies in central banks has resulted in an increase in wealth inequality, which in turn has led populist movements in Europe and America to emerge, economies to destabilize, and uncertainty to increase. In the future, expansionary monetary policies will be increasingly difficult tools to justify, as there is growing concern at all levels that they are unsustainable.

- Inflation rates are not responding to current monetary policy, despite the sustained low interest rates and despite central banks’ asset-purchase programs. With markets at record-high levels, a new wave of quantitative flexibility could send a message of uncertainty (similar to what happened toward the end of 2018 when markets all over the world dropped) and would, in fact, speed up a global recession.

The recent increase in repo operations by the Federal Reserve has shown that markets’ real liquidity is much lower than expected. It has also demonstrated that agents’ levels of debt are probably higher than predicted, as the markets need continuous assistance from monetary authorities.

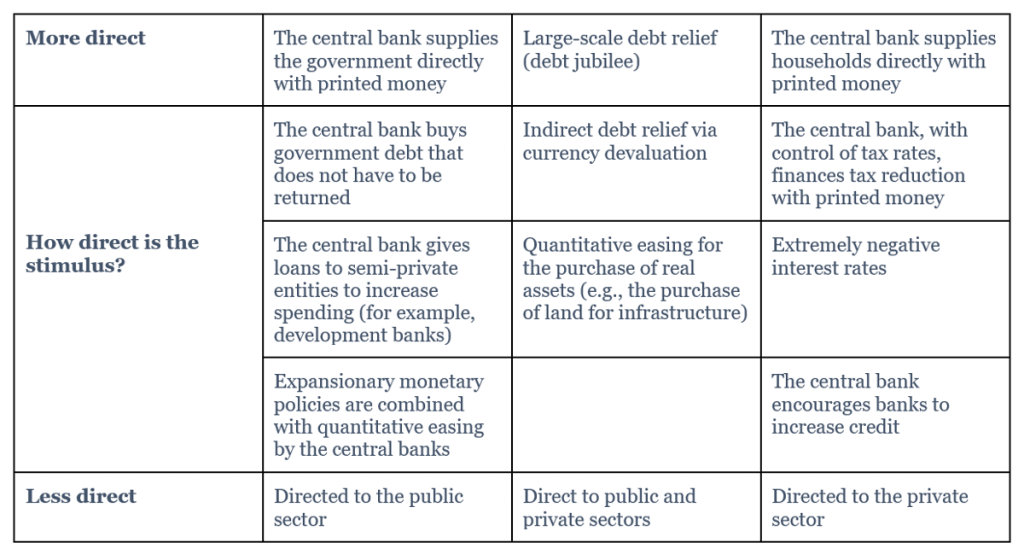

In this context, we believe that the economy will move into uncharted territory as the next recession approaches, which will very likely provoke central banks and governments to enact another wave of action plans. As described in the Bridgewater Associates paper “It’s Time to Look More Carefully at Monetary Policy and Modern Monetary Theory,” the two defining aspects of the new set of policies will be:

- which sector the spending will stimulate (public versus private)

- how direct the stimulus will be (central banks provide “helicopter” money directly to consumers or they enact indirect measures and engage in open market operations)

Chart 2 – Bridgewater Associates

Although some of these initiatives may seem outlandish, it is useful to remember that the majority have historical precedents. For example, central banks gave recently printed money to governments to spend without having to issue new debt in the United Kingdom during World War I, the United States in the Civil War, and Imperial China. And Imperial China’s government printed money and directly transferred it to households during the Ming Dynasty in 1390, which led to a dramatic currency depreciation.

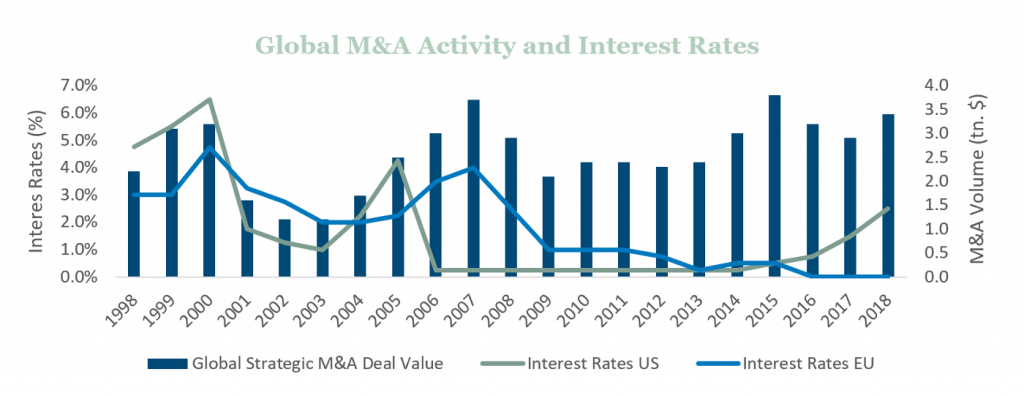

One must keep in mind that low interest rates have affected not only financial markets but also real assets, business investments, and the intensity of corporate mergers and acquisitions. The strong QE has brought with it more liquidity and lower credit cost, which has resulted in a significant decrease in the weighted average cost of capital (WACC) for businesses. For example, the WACC of the S&P 500 has been decreasing constantly in recent years; according to Bain in “Rethinking M&A Valuation Assumptions,” it has declined more than 20 percent.

In general terms, low interest rates have increased the prices of assets and decreased their associated expected returns. This is because companies have not adjusted their internal rates of return in keeping with the decline in the WACC because they believe interest rates will rise soon (JP Morgan’s “Bridging the Gap between Interest Rates”). M&A (mergers and acquisitions) activity, driven by a favorable economic environment, has been very strong in recent years, but not as strong as might be expected. As a result of the discrepancy between the internal rates of return for companies and the WACC, interest rates’ link with business investments and corporate operations has been broken, as can be seen in the following graph.

Perhaps a new situation is looming in which

- interest rates remain at very low levels,

- central banks launch new asset-purchase programs, and

- government authorities develop a new set of monetary and fiscal policies for a more direct stimulus.

If so, how could this affect corporate investment and M&A activity? Most likely, in the next recession, a new wave of policies will induce an uptick in inflation, which will eventually lead to an increase in interest rates, increasing the capital cost of companies and decreasing the price of assets.

Low interest rates have increased the price of assets. However, the discrepancy between the low cost of capital and companies’ higher internal rates of return has led to a lesser rebound in business investment and corporate operations than one would expect. Similarly, it is highly probable that the exact opposite could come to pass in the future. In other words, the effect of the higher borrowing cost — potentially induced by the inflationary fiscal and monetary stimulus — will be offset by the subsequent correction of the financial-asset market and the decrease in asset prices. It is true that an increase in interest rates will lead to a rise in companies’ cost of capital, but this increase will cause the relationship between capital cost and corporate activity to return to equilibrium and it will cause corporate operations to increase as the prices of assets decrease.

Obviously, the current economic and market conditions, the new monetary policies that could be introduced in the next recession, and the existing (and growing) political and trade tensions introduce many unknown factors whose impact is less than clear. However, we believe that unless there are abrupt changes and disruptions in markets and the global economy, investment activity, along with M&A, should not be significantly influenced by the incremental cost of capital. In the next recession, and with the next monetary and fiscal policies, perhaps inflation will appear again. This would mean increases in interest rates and companies’ cost of capital. In our opinion, inflation will not have a negative effect on corporate operations, but rather the exact opposite, as the prices of assets will decrease, with internal rates of return and the cost of capital returning to their natural equilibrium.

Legal notice: the analysis contained in this article is the exclusive work of its author, the assertions made are not necessarily shared nor are they the official position of the Francisco Marroquín University.

–

Get our free exclusive report on our unique methodology to predict recessions

Edgar Fernández Vidal

Prior to joining Liceo Capital Advisors, Mr. Fernández worked at top international – Amiral Gestion in Paris – and national investment funds – Queka Real Partners – where he performed strategic and financial analysis of potential investment opportunities, as well as in-depth market, industry and economic research.

Edgar is also an Associate Professor, teaching Investment Strategies and Valuation, at the ISBIF in Madrid. He is also speaker in economic conferences and at international research centers such as the Austrian Economic Center.

Jorge López Moreno

Jorge founded Liceo Capital Advisors after several years of experience as investor and management positions in London and Madrid, and having participated in investments and projects in UK, USA, UAE, Canada and Switzerland.

He is a graduate in Industrial Engineering from ICAI (Excellence diploma and scholarship from the city of Madrid), has a M.Sc. degree in Mechanical Engineering from Ecole Polytechnique Fédérale de Lausanne, EPFL (awarded the Zanelli prize for his Master thesis research work), and has an MBA from Harvard Business School, where he was appointed by the Finance Unit faculty as tutor for first year Finance students. He started his career as a process engineer at Nestlé in Switzerland.

Jorge has worked for global private equity funds such as H.I.G. Capital, with more than USD 30 bn. Of assets under management, and collaborated with the Canadian Pension Plan Investment Board, with more than USD 350 bn of assets under management – CPPIB – on specific projects. He was also an Investment Associate at GSP Capital, a London-based Family Office.

Get our free exclusive report on our unique methodology to predict recessions