Cheap Oil and Why OPEC Can’t Do Anything About It

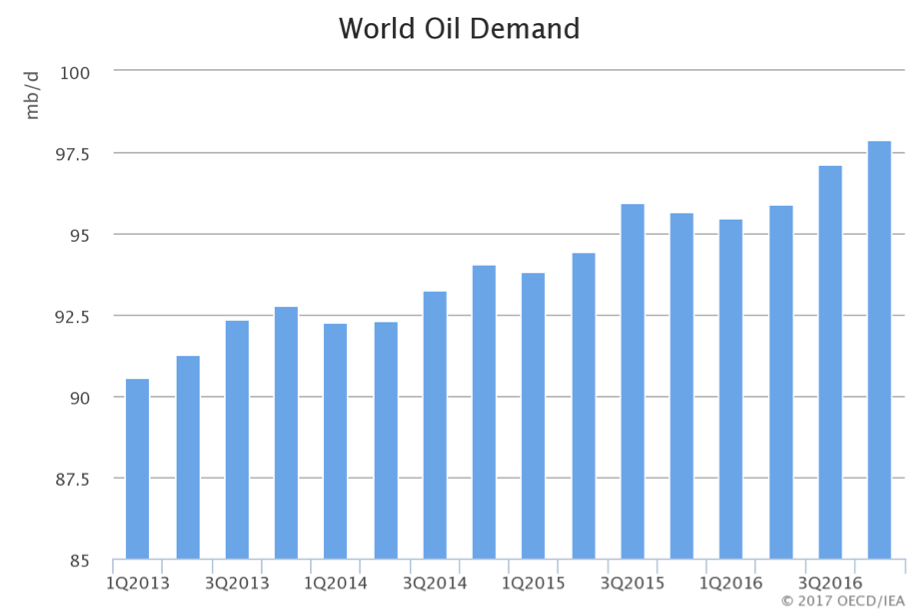

Beyond the behavior of speculators or OPEC—which some consider a cartel, if there is anything we can learn is that the fall in oil prices responds to the forces of supply and demand. On the demand side, lower economic activity throughout the world, specially in China, has lowered the price of oil. Projections by the International Energy Agency show how demand weakened in 2014, although it rebounded in 2016.

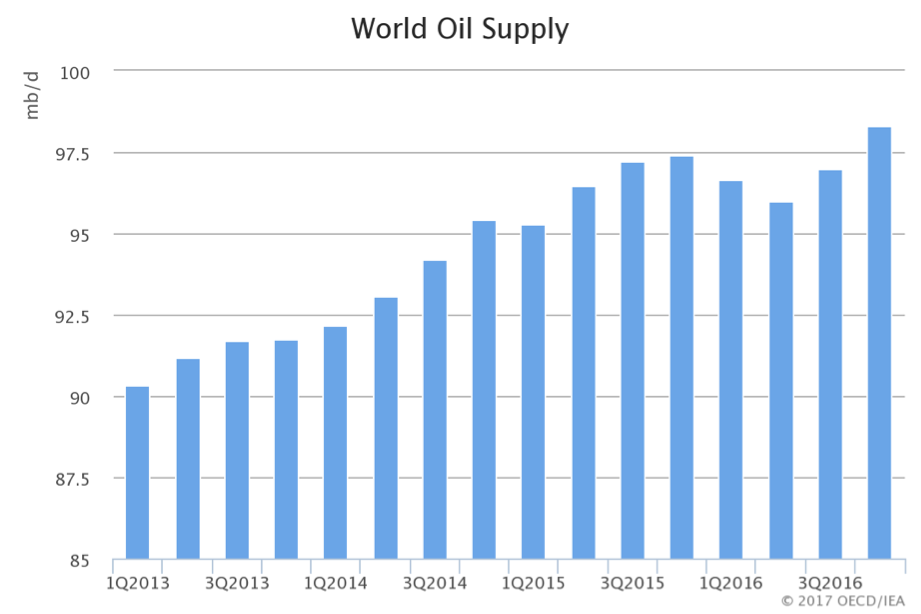

However, there is no doubt that the supply side saw the most significant change. There has been much talk about fracking and how this technology—implemented primarily in the United States—has affected the oil supply. Between 2008 and 2014, the US oil supply increased by 76%.

This shock in the supply of oil and the weak demand has accustomed people to low oil prices. In 2016, the average price of a WTI barrel was valued at $43.15. In June 2016, the price was over $90. In just one year, from June 2014 to June 2015, the price of a barrel fell 43%.

The shock in the supply will not last forever: producers have different marginal costs. In the past, high oil prices made new forms of production with greater marginal costs profitable. If prices remain low, some producers could exit the market and there would be a price adjustment. Yet, there are good reasons to think that oil won’t reach the exorbitant prices of early 2014.

The question many are asking is: why hasn’t OPEC acted to keep prices from remaining low? To answer this question, we need to examine whether OPEC is able to manipulate prices.

Is OPEC a cartel?

Economists define a cartel as a group of producers that come together to plot in the market. In other words, a group of producers agree to restrict supply and maintain prices at a certain level, making their incomes greater. However, for this to happen the members of the cartel need to have a dominant position in the market.

Although many economists consider OPEC a cartel, the question becomes difficult to answer when we look at historical data. In their book The Price of Oil, Roberto Aguilera and Marian Radetzki lay out empirical evidence showing that, historically, OPEC has not been able to act as a cartel. OPEC’s policy has always consisted in setting maximum production quotas to keep the supply below a certain level; yet these quotas are rarely followed and OPEC countries generally produce at 94% of their capacity.

On the other hand, OPEC’s market share does not clearly show a dominant position in the market that would allow them to directly influence prices. According to Aguilera and Radetzki, OPEC’s market share has varied between 31% and 56%. Although it might seems like a large share it is not, specially if we compare it to other minerals such as bauxite where there is a supply concentration of 73% to 81%.

OPEC has announced that it hoped to reach an agreement to extend the output cuts of major oil-producing countries. Certainly, the quotas fixed by OPEC have an influence on the price of oil, but this does not make OPEC a cartel. Only the future will tell if OPEC’s measures have any effect on oil prices or if our interpretation that they aren’t able to move prices is true.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions

UFM Market Trends, los felicito porque sus análisis están trascendiendo internacionalmente! El enlace para llegar a este artículo lo encontré usando la aplicación Flipboard, con el tema Oil, donde leo diariamente autores de todo el mundo sobre este tema. Felicitaciones.

¡Muchas gracias, Roberto! Qué buena noticia leer esto.