The Accounting Cycle and Financial Bubbles: On the Current Indifference on Accounting Methods

In 2007, value investor David Einhorn wrote a fascinating book titled “Fooling Some of the People All of the Time: A Long, Short Story”, which is about how companies over the course of the business cycle begin using accounting tricks and the indifference of stock investors as long as stock prices are rising. This “accounting cycle” is intimately connected to the business cycle. In boom times, businesses can easily get away with creative (though, in many cases, perfectly legal) accounting methods, only to be corrected by markets when a recession sets in. I argue that the current cycle is nothing different. And I will share a few cases which prove my point.

Netflix: Accounting for Content

Any content spending, in the case of Netflix, is recorded on the asset side of its balance sheet (initially as a non-current content asset). Then, content assets are gradually amortized over time. According to a recently released document by Netflix, which explains how content spending is accounted for, Netflix writes off 90% of the value of a content asset within four years. Netflix does not disclose exactly at what rate, on average, so we have to second-guess how Netflix is really amortizing individual series, seasons or movies.

No disclosures are made on what happens when a movie or series is a complete disaster; is the asset written off completely? Most likely it isn’t. Let’s take Marco Polo, which was the most expensive Netflix original at the time. According to some estimates, the production of Marco Polo cost close to $200 million dollars. The first seasons flopped and Netflix decided to cancel Marco Polo all together. Writing down the entire $200 million dollar, shareholders would take a $0.46 hit on earnings.

However, if Netflix gradually writes down over four years, it would spread the loss over four years or longer. Investors are currently expecting $0.32 of earnings per share over the current quarter. Put differently, writing off Marco Polo would lead to negative instead of positive earnings.

But that is not the key takeaway: Netflix’s content spending resembles more operational than capital expenditures. And as it records content assets with a lifespan of multiple years while subscribers are binge watching their favorite content in days and not years, Netflix is inflating its bottom line. This is the reason why Netflix is showing a profit while it is burning through cash. But as Netflix embarked upon its very own binge, binge content spending, it is not taking into account that subscriber growth and churn will rapidly worsen as soon as it cuts its content spending. In other words, Netflix is unprofitable and its cash flow statement is a clear proof.

So how does Netflix get away with this?

The answer is sad: during a boom, investors tend to look away from anything that could end a rally. As long as returns are positive and high, nobody worries about where earnings are coming from (that is, earnings quality). The narrative is clear: Netflix is growing, and all that matters are the number of new subscriptions signing up and steadily growing earnings.

Tesla: The Gross Margin Charade

Tesla is a tremendous cash burner and due to its significant cash outflows, it depends on outside financing. Outside financing depends on the willingness of capital allocators on financial markets to provide that capital. However, most capital allocators (investors) seem to be fooled by Elon Musk’s hypnotizing focus on two variables: deliveries and gross margins.

And it’s all about gross margins, right? Wrong.

Supposedly, Tesla maintains far higher gross margins on its cars than any other car manufacturer (28% compared to General Motors’ 18% and Ford’s 10%). But there are few (accounting) reasons why Elon Musk’s narrative is completely false and achieved with diverging accounting standards:

- Most car manufacturers include R&D in gross margin

Producers have to innovate constantly to remain competitive in a technology-driven industry as the automotive industry. Therefore, most producers invest a lot in R&D and include it in their gross margin calculations. However, Tesla does not, overstating its gross margins compared to other car manufacturers comparing apples to pears. Vincent Wolters showed that when you account for R&D, Tesla’s gross margins are roughly equal to its competitors and have not gotten better over time (despite alleged economic of scale). - Accounting for distribution

Unlike other car manufacturers (who sell their cars at a 10% discount to independent dealerships), Tesla distributes cars through its own Sales Centers. However, Tesla does not include these centers in its cost of revenues. Therefore, its gross margin is overstated next to its direct competitors. - Free supercharging not accounted for

Tesla, as part of its initial sales package, offers life-long super charging across its proprietary super charging network (Tesla quit offering free super charging on new models). This means that every Tesla-sale came along with significant future costs. Tesla accounts for these future outlays by deferring revenue. The deferred revenue should be able to cover the outlays to make a whole on its free charging promise. However, it doesn´t. Alberto Zaragoza did a great job in showing that Tesla only accounts for less than 40% of the real cost of its supercharging obligations. That implies a large future write off. Curiously, the only way out of this costly promise is to file for Chapter 11 bankruptcy.

Tesla´s gross margins are inflated.

Alphabet, Procter & Gamble & Microsoft: The Non-GAAP Earnings Inflation

Generally Accepted Accounting Principles (or GAAP) is the accounting standard adopted by the SEC. Publicly-listed companies in the US are obliged to follow GAAP standards when filing their financial statements.

However, companies sometimes deviate from these standards in their reporting. While there might be legitimate reason to deviate from GAAP, US corporations are obliged to disclose whether they are referring to GAAP or non-GAAP numbers. And whenever they report a non-GAAP measure (for instance, earnings) then they are in many cases also obliged to report the corresponding GAAP figure. Curiously enough, companies are allowed to issue press releases while only referring to non-GAAP figures. These press releases are used by the press to write their headlines.

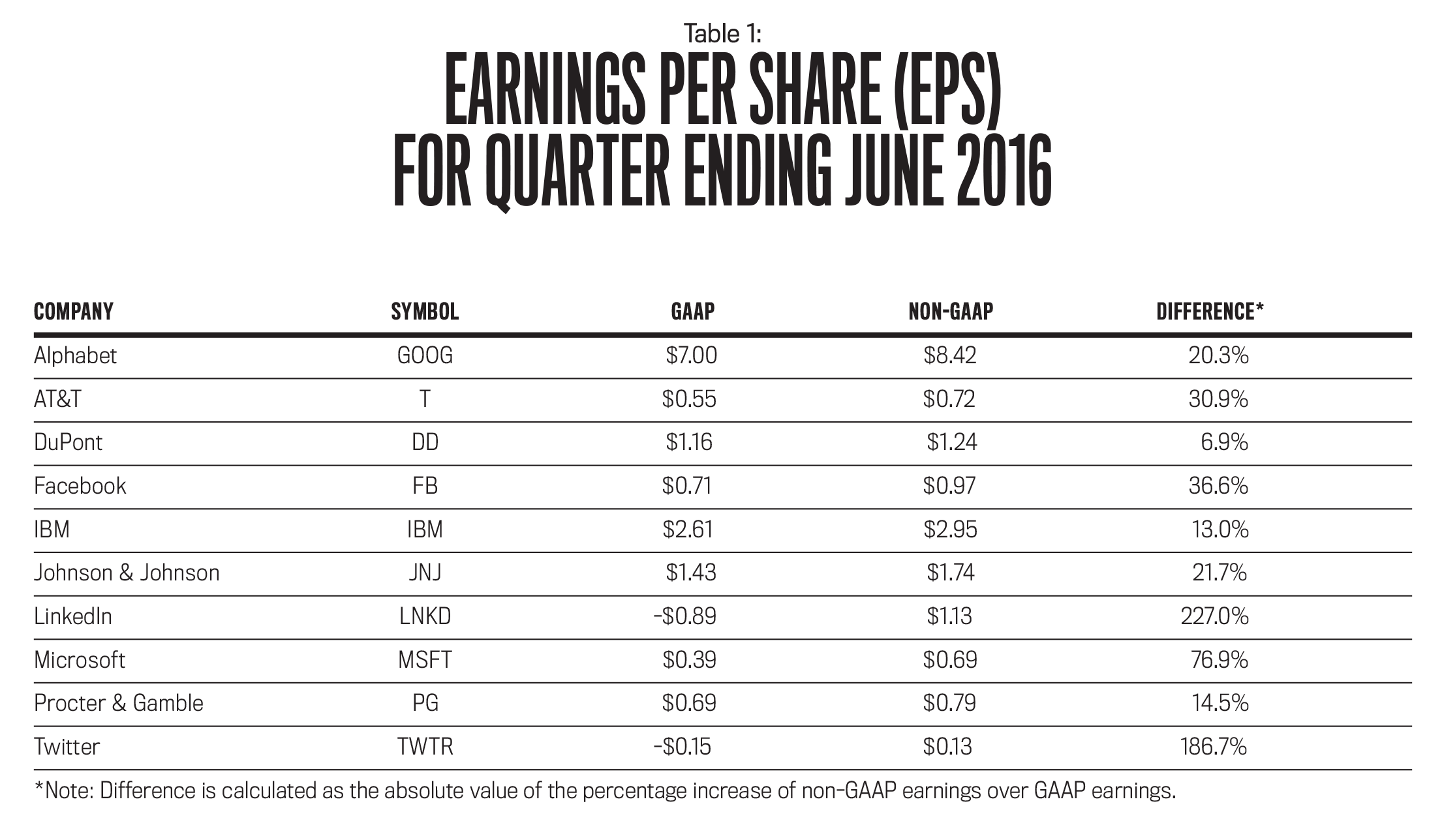

Deviating from GAAP is, however, often a way to artificially inflate the bottom line by accounting away some inconvenient truths to a business. Take a look at how GAAP earnings per share differ from non-GAAP earnings among major US companies:

Source: Thomas A. King in Strategic Finance

Source: Thomas A. King in Strategic Finance

Notice that in all cases, non-GAAP earnings are higher than GAAP earnings, in some cases even turning losses into profits.

A coincidence? Not so much.

Over the course of a business cycle investors become complacent. Companies follow non-GAAP earnings to impress investors, and make possible a gradual, upward growth trend in earnings. In other words, deviating from GAAP allows companies to show better figures than they really are, something Thomas A. King explained in greater detail here.

This is clearly proven by the fact that there is absolutely no consistency as to what the deviation consists of: stock-based compensation, intangibles, takeovers, insurance, pensions, derivatives, etc. Boards seem remarkably skilled in cherry-picking accounting methods to artificially inflate the bottom line.

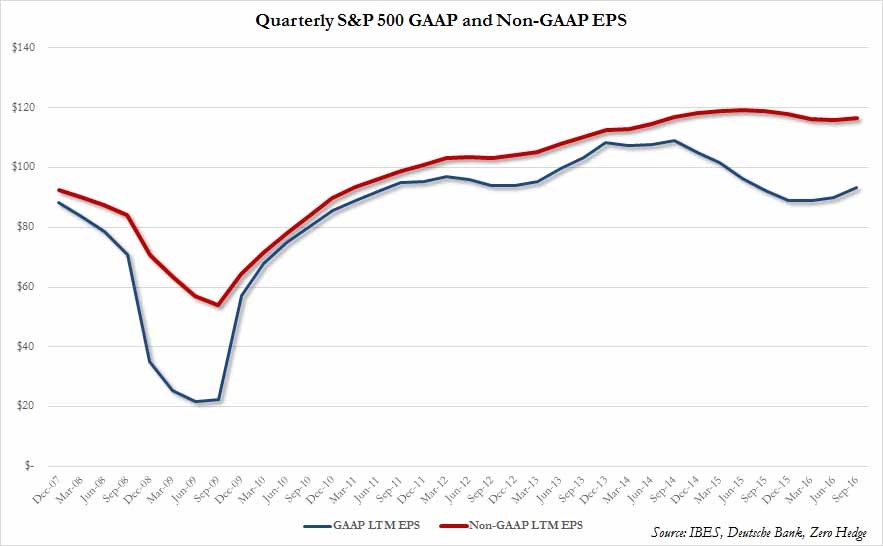

This tendency of inflating profits becomes greater and greater during an economic boom, only to be corrected during a recession. And right now, more and more companies are diverging from GAAP to report non-GAAP earnings and other performance indicators. Courtesy of Zero Hedge, you can observe in the following chart how in the past few years the use of non-GAAP accounting has proliferated:

What does this imply for investors right now?

- Many companies are inflating profits in the short-term at the expense of the longer term.

- Stocks are in reality far more expensive than non-GAAP price/earnings (P/E) ratios would suggest

- Stocks which show a greater divergence between GAAP and non-GAAP measures might fall harder in profits and in price in the future

The accounting cycle goes hand in hand with the business cycle. And this time around things will not be any different.

Get our free exclusive report on our unique methodology to predict recessions

Olav Dirkmaat

Olav Dirkmaat is professor in economics at the Business School of Universidad Francisco Marroquín. Before, he was VP at Nxchange and precious metals analyst at GoldRepublic. He has a PhD in Economics from the King Juan Carlos University in Madrid. He has a master in Austrian Economics from the same university, as well as a master in Marketing Strategy from the VU University in Amsterdam. He is also the translator of Human Action of Ludwig von Mises into Dutch. He has a passion for investing, and manages funds for relatives, looking for investment opportunities in markets that are extremely over- or undervalued.

Get our free exclusive report on our unique methodology to predict recessions

You ought to be a part of a tournament personally of the most useful blogs on the web. I am going to recommend this page!