Brazil Coming Out on Top among Financial Markets

By Ángel Martín Oro May 23, 2016

Translated from Spanish by Robert Goss

A pleasantly optimistic surprise in the financial world during the first part of the year has been the performance of emerging markets. After years of poor performance, both in absolute and relative terms, these markets have finally produced some good news for investors. The aggregate index for emerging markets has increased 6.6% so far this year. Compare this to an increase of only 1.8% for the S&P 500 and a decrease of 3% in Eurostoxx 50 (data in dollars taken at an April 15th close from perpe.es, unless otherwise indicated).

However, as is the case for all aggregations, some major differences among the markets go unseen. When analyzing the average increase, what stands out is the fall of more than two points in the securities exchange of China or the moderate decline in India.

On the plus side, the leaders of the emerging markets can be found in Latin America: the market of Peru has seen a 30% increase in local currency while Bovespa of Brazil experienced an increase of 22.8%. Not far off, the markets of Russia and Turkey saw a 20% increase and that of Colombia, a not-too-shabby 17.5%.

But if we measure these markets using a reference currency, such as the dollar, the frontrunner is clearly Brazil with a 39% yield in only three and a half months. Who woulda thought!

Performance of the Brazilian market over the last 5 years, by means of ETF EWZ and the depreciation of the real.

Source: Yahoo Finance

As written previously by Edgar Ortiz in this article, The Brazilian recession has reached new lows and its future is nothing to write home about. Nevertheless, the financial markets and its recent surge – following a collapse as shown in this graph – are optimistic about the future and may base themselves on two fundamental pillars.

First, the political change to be seen following corruption and scandals that have come to light and the recent impeachment of Rousseff. It is clear that the market never much favored Rousseff and this was made obvious by its actions in light of recent news concerning the impeachment process. But the current situation is complicated, and the impeachment of the president does not guarantee a transition to a pro-market government.

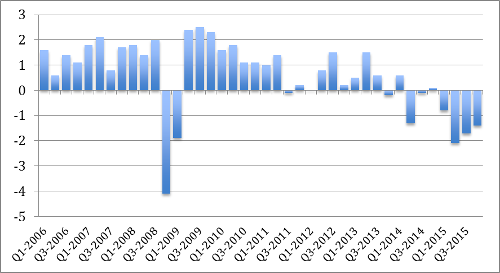

Second, a macroeconomic turning point. This is a common belief among some investors that are seeing encouraging signs even as pessimism prevails about economic growth in Brazil. On one hand, if we measure growth rates on a quarter-on-quarter basis, we see that the drops in economic growth have decelerated, which may indicate that the worst is over..

Quarter-on-quarter Brazil GDP Growth Rate (%)

Source: Self-prepared using data from OECD

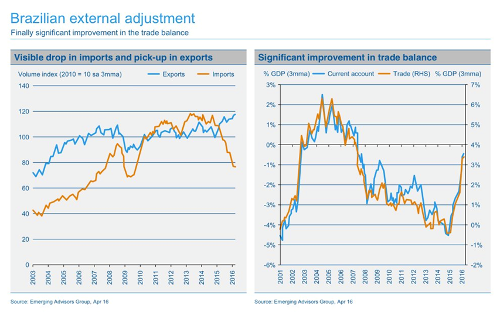

On the other hand, the significant depreciation of the real has facilitated the external adjustment of its economy, as shown in the following two graphs provided by Aberdeen Asset Management.

Source: Aberdeen Asset Management

All this, remembering the global situation in recent months, characterized by the surge in commodities and the drop in the dollar, due to the gradual rise in interest rates by the Federal Reserve.

This behavior in the Brazilian market can be analyzed in various manners as we have seen. But what it most undoubtedly shows us is the velocity at which the values of financial assets can change. Also, it is likely that the beating experienced by the Brazilian market was excessive, leaving assets at attractive prices for the long-term investor.

Get our free exclusive report on our unique methodology to predict recessions

Ángel Martín Oro

Ángel Martín Oro is VP of Spain at UFM Market Trends in collaboration with Instituto Juan de Mariana. He is also a PhD-candidate in economics. He is also a senior consultant at iDen Global and was previously an editor at the financial portal inBestia.com. In addition, he is a professor of the OMMA Master of Economics. He is the author and co-author of numerous reports and articles, published in Spanish and international media, such as the Wall Street Journal and the Cato Institute.

Get our free exclusive report on our unique methodology to predict recessions