Putting Spain’s Growth in Context

By Ángel Martín Oro September 15, 2015

The positive macroeconomic data coming from the Spanish economy contrasts with the economic deceleration experienced by the global economy. During the second quarter of 2015, Spain’s real GDP continued to grow, exceeding 3%. The question is, Will Spain continue to experience economic growth in spite of sluggish global economic growth?

First, regardless of why Spain is experiencing this positive GDP growth, there are some signs that this growth could slow down in the third quarter. For example, PMI for the manufacturing sector has fallen from 55.8 in May to 53.2. Data from Spain’s social security has also shown signs of the economy slowing down.

Second, what will be the impact of the problems experienced in emerging markets? What consequences could the continued deceleration of China’s economy have?

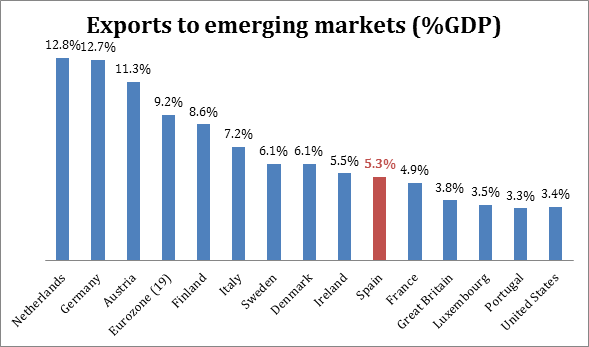

More than the spillover effects that this could have (and that shouldn’t be overlooked), what the data points to is that Spain’s relatively low exposure to emerging markets, unlike exporting nations like Germany, actually helps in this situation.

Source: J.P. Morgan with data from Eurostat and Bloomberg

Spain’s exports to emerging markets account for only 5.3% of the country’s GDP. Compare this to 12.7% for Germany and 9.2% for the eurozone (19). When it comes to exports to China, this figure drops to just 0.4% over GDP representing 1.7% over total exports for the first semester of 2015.

Given that Spanish exports to the EU account for almost 65% of total exports, recent upticks in the EU economy have a greater impact on Spain’s economy than the downturns of the Russian, Chinese, or Brazilian economies.

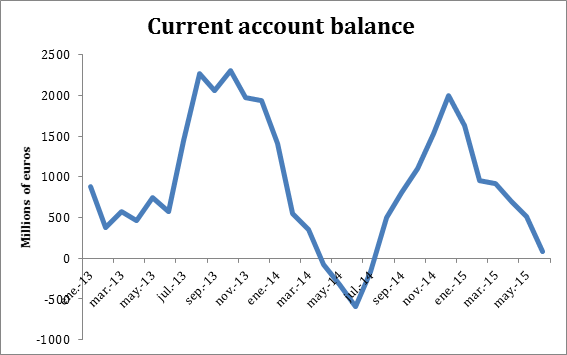

Spain’s current account balance up to this year’s second quarter gives more insight into why this is the case.

The first quarter of 2015 yielded a practically balanced current account, compared to the 3.6 billion euro deficit for the same period in 2014. Looking at these numbers on a yearly basis (July 2014–July 2015), Spain has a current account surplus close to 1.2% of GDP.

This year’s second quarter registered a surplus of 2.3 billion euros (0.82% of GDP), this figure is much higher than the 109 million euro surplus experienced last year during the same period.

Source: Bank of Spain. Six-month moving average.

A key factor for these positive indicators is the energy deficit reduction due to falling oil prices. This is good news for the Spanish economy, as it can help stem the tide of the global economy’s deceleration.

A more detailed analysis of the Spanish economy will be found in the UFM Market Trends 2015 second quarter report.

Get our free exclusive report on our unique methodology to predict recessions

Ángel Martín Oro

Ángel Martín Oro is VP of Spain at UFM Market Trends in collaboration with Instituto Juan de Mariana. He is also a PhD-candidate in economics. He is also a senior consultant at iDen Global and was previously an editor at the financial portal inBestia.com. In addition, he is a professor of the OMMA Master of Economics. He is the author and co-author of numerous reports and articles, published in Spanish and international media, such as the Wall Street Journal and the Cato Institute.

Get our free exclusive report on our unique methodology to predict recessions