Nominal GDP Target for the United States?

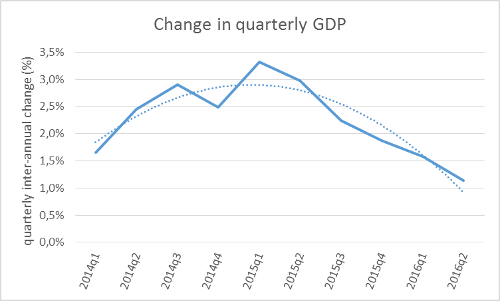

The Federal Reserve may find itself in an awkward moment when it comes to the performance of the US economy: as shown in graph 1, the US economy has been growing at declining levels since Q1 2015.

Graph 1

Source: Bureau of Economic Analysis, compiled by Bloomberg

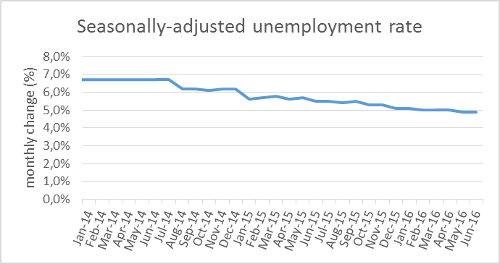

The unemployment level in the United States has not changed since Q4 2015; it remains at a rate of about 5%. Furthermore, the percentage of the population participating in the labor force is increasing—slowly, but increasing nonetheless.

Graph 2

Source: Bureau of Labor Statistics

Why isn’t the United States growing at higher rates?

The press is uneasy and is starting a debate on whether central banks should abandon their inflation tagrtets, focusing instead of nominal GDP targets.

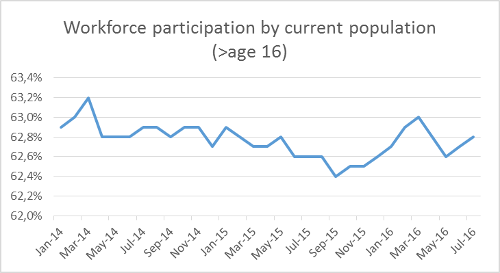

The inflation target does not seem to be giving the expected results. The Federal Reserve is not able to achieve the results it wants from the established inflation target—Graph 3 shows how the inflation target of 2% is still far away. Annual inflation, as of July 2016, it at 0.6%.

Graph 3

Source: Bureau of Labor Statistics, compiled by Bloomberg

The hypothesis presented by UFM Market Trends states on why the United States is not growing at the expected rate—or at the rate desired by the press and the Federal Reserve—explains that it is because the economy is undergoing a reconfiguration. The economic agents seem to have learned from the excess of leverage. During the last seven years credit volumes did not grow as as in previous liquidity periods, despite having the federal reserve interest rates close to 0%. This means the US economy is not expanding. Similarly, business performance at the end of 2015 was revealing: the physical economy is being replaced by a virtual one. What does this mean? This simply means that retail companies are beginning to have dimisinihing results and are no longer the most important in the country’s consumer economy. Virtual companies are dislacing traditional retail ones in the United States.

An economy that is shifting from a physical economy to a virtual economy, from an overleveraged economy to one with prudent levels of debt, is an economy that is being reconfigured to rise from its ashes. The recently introduced debate on whether the central banks of developed countries should avoid inflation targets and adopt nominal GDP targets is the biggest threat the US economy faces. Changing the inflation target to a nominal GDP target would imply facing the old problem of excess money in the economy. If the Fed is not tempted to change the inflation target for a nominal GDP one, in a few quarters the US economy will most likely see a more robust growth. For details of the US economy, see the Market Trends UFM report for Q2 2016.

Get our free exclusive report on our unique methodology to predict recessions

Clynton López

Clynton López is a professor at the Francisco Marroquín University since 2002 in the areas of economics and philosophy. He has a degree in Economics with a specialization in Finance from the Francisco Marroquín University and a master in Economics from the same university, both Magna Cum Laude. He studied executive programs at Boston University on Managerial Economics & Corporate Finance, the Master of Philosophy at the Rafael Landívar University (specialization in phenomenology), and the Post Graduate Degree in INCAE for Senior Management. In the professional field he has more than 10 years of management experience in banking and financial companies in Guatemala, California and Puerto Rico, and is a member of the Mont Pelerin Society.

Get our free exclusive report on our unique methodology to predict recessions