The Yen’s Depreciation

By Edgar Ortiz Romero June 30, 2015

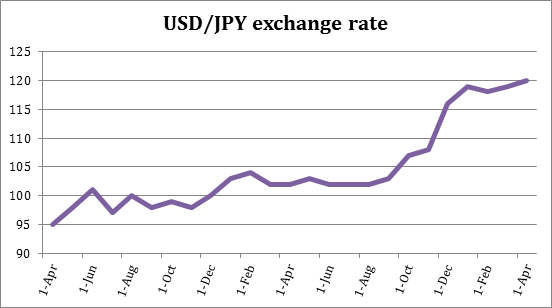

The exchange rate in Japan has settled around 123.70 yen per US dollar.[1] When quantitative easing (QE) was launched in Japan in April 2013, the Japanese yen (JPY) was trading at around 95 yen per USD. Thereafter the yen declined slightly, but it wasn’t until September 2014 that the yen accelerated its pace of depreciation against the dollar.

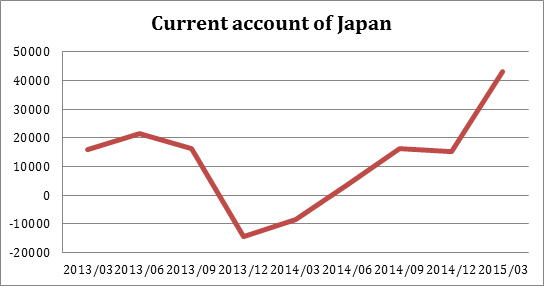

Exchange rates are generally explained as a function of the movements in the balance of payments. In the current account, it’s generally observed that rising exports will strengthen the exporting country’s currency and rising imports will have the opposite effect.

Similarly, in the financial account, an increase in monetary flows from foreign direct investment or investment portfolios will strengthen the currency of the country receiving the flows or it will weaken the currency if the balance is negative.

If we tried to explain the USD/JPY exchange rate only in terms of the trade balance, we wouldn’t be able to. As seen in the chart below, Japanese exports have been growing since the end of 2014.

What, then, is missing in order to explain this phenomenon? We must take a close look at the factors that compose the demand for money: the marginal propensity to save and the expected return of the currency. The first factor is the proportion of income that economic agents save in the form of financial assets, including currencies. The expected return refers to the currency’s liquidity and risk.

In the case of Japan, it’s important to note that due to the increase in sales taxes and the decline in real wages of Japanese workers, the country’s savings rate turned negative for the first time, ending at -1.3% in 2014 (Yueh, 2014). The decline in savings results in a higher rate of swapping out of cash and into goods, which in turn weakens the currency’s value.

To this we must add the expectations that the market has about the yen. And it’s precisely because of the expected return or market expectations that there has been an increase in short positions, or bets against the yen, since September 2014 (Adinolfi, 2015).

This second factor is key. In a global context, investors have a wide range of options to invest in fiat currencies that offer different “returns” (reflected by their purchasing power). In this regard, the previously mentioned monetary stimulus that began in 2013 as part of Abenomics has begun to hurt local price indices, which in turn has raised the alarm of investors and has led them to pile on short positions.

The consequences of Abenomics on the yen are starting to be felt. While the country’s exports have increased, it’s still unclear that a “weaker” currency is the right solution for Japan, which is not focused on exporting low-value products. This will be further examined in a future article.

References

Adinolfi, Joseph. Marketwatch. June 1, 2015.

http://www.marketwatch.com/story/hedge-funds-just-made-their-largest-bet-against-the-yen-in-nearly-3-years-2015-06-01?siteid=rss&rss=1.

Yueh, Linda. BBC. December 26, 2014. http://www.bbc.co.uk/news/business-30603313.

[1]. As of June 23, 2015.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions

The United States men’s amateur national rugby team constitute the largest phase of the United States inhabitants in men’s professional world rugby. Named the Eagles, it is technically ruled by USA Rugby, the governing body for this sport of rugby in the whole country. A number of other teams and corporations exist in association with the Eagles and some of their memberships. Some of these are centered in Florida, while others are based in Maryland. All these different affiliates of the Eagles are part of the United States rugby organization (USRSA).