The U.S. and the Fall of the Federal Reserve

By Clynton R. López F. May 26, 2016

Translated from Spanish by Robert Goss

This article in an excerpt from the U.S. economy report and can be found here.

Typically, it is believed that a nation’s central bank is the resolute decider of the economy of its nation. In today’s day and age, in the political-economic establishment of international bureaucracies, it is easy to envision the end of the world for some nations without the central bank.

The Federal Reserve is the central bank of the United States. It serves as a decentralized entity broken up into 12 districts across the country and a Board of Governors in Washington D.C. Founded in 1913, its decisions throughout history have always proven to be controversial. According to Milton Friedman, during the crisis of 1929, its actions were crucial in the worsening of the depression, and he stated that the Fed took actions that it should not have. Basically, it did not properly carry out its responsibility as lender of last resort and allowed for the drastic decline of money in circulation in the U.S. economy. As per Bernanke (2012)[1], when the Federal Reserve abandoned the gold standard in 1933-34, it was then able to stimulate the economy and recover from the crisis. Through this mainstream historical interpretation about the role of central banks, more and more control over nations’ economies has been bestowed upon them. The realm of responsibilities of central banks stretches to include the following: 1. Monetary Policy (a monopoly over the issuance of money), 2. Lender of last resort in the financial system, and 3. Regulating and monitoring of financial system. These responsibilities have been granted to the central bank to achieve macroeconomic stability in the country. Often times, this objective translates into meaning that central banks are responsible for creating proper conditions for economic growth and avoiding recessions.

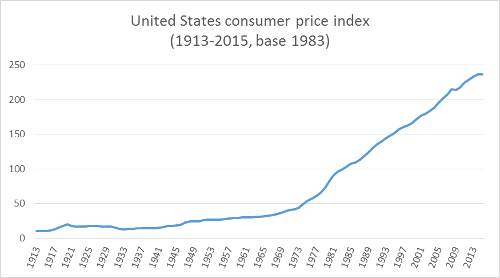

Graph 1

In Graph 1, we can see the course of the Federal Reserve throughout history with respect to price stability. In very general terms, it can be deduced that inflation is the price paid so that the Federal Reserve can carry out a monetary policy aimed at stabilizing the economy. One of the most important monetary policy instruments used by the Federal Reserve is the federal funds rate. This is considered to be of such importantce, because throughout time, it has proven to generate an effect in economic agents.

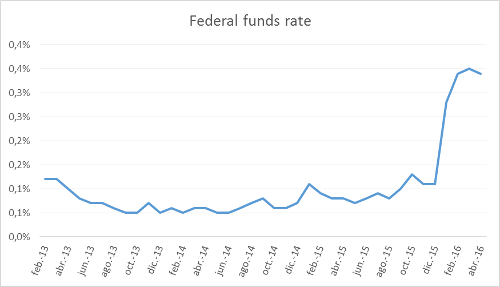

Graph 2

Graph 2 shows us the cost of federal funds in the last 3 years. Looking back, in the last 7 years and in practical terms, the federal funds rate remained at zero. Did this generate the desired effect for economic agents? During this time, the U.S. economy did not see an increase in credit extended at any level, and there was an increase in excess in reserve in private banks, as shown in Graph 3.

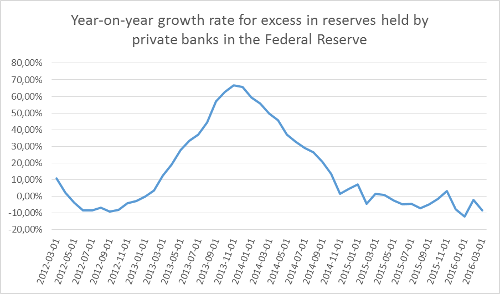

Graph 3

Up until 2014, federal funds growth rates were positive. As of 2015, the growth rate began to show certain volatility, but the net effect continues to be that the amount of excess reserves remains at relatively high levels.

Since 2007, the weight held by the Federal Reserve in the U.S banking system has increased from 7% to 28%. These figures correspond only to banks within the FDIC[2]. Currency in circulation has risen at a yearly composite rate of 7%. In contrast to money in circulation (printing money), deposits made by private banks in the Federal Reserve have raised by a yearly composite rate of 4%. This means that a significant amount of this money printed (the monetary incentive) ended up in the very same vaults of the Federal Reserve Bank.

Despite the fact that, in relative terms compared to the FDIC, the Fed has grown four-fold since 2008, it has been incapable of having an important effect on economic agents. On April 28th, first quarter economic growth in the U.S. was announced to be at 0.5%. Credit rates continue without seeing year-on-year growth rates of more than 1%, and inflation, after a considerably long period, is finally at positive levels.

It is quite probable that we are in a time where we are experiencing the threshold of the monetary policy. Central banks are not all-powerful and perhaps as a result, a discussion can spark regarding the costs and benefits of constructing a nation’s economy around them (in the case of the Federal Reserve, a world economy)

More information about the economy of the United States can be found in the quarterly report by Market Trends.

[1] Ben Bernanke. The Federal Reserve and the Financial Crisis, (New Jersey: Princeton University Press, 2012). P., 23.

[2] Federal Deposit Insurance Corporation.

Get our free exclusive report on our unique methodology to predict recessions

Clynton López

Clynton López is a professor at the Francisco Marroquín University since 2002 in the areas of economics and philosophy. He has a degree in Economics with a specialization in Finance from the Francisco Marroquín University and a master in Economics from the same university, both Magna Cum Laude. He studied executive programs at Boston University on Managerial Economics & Corporate Finance, the Master of Philosophy at the Rafael Landívar University (specialization in phenomenology), and the Post Graduate Degree in INCAE for Senior Management. In the professional field he has more than 10 years of management experience in banking and financial companies in Guatemala, California and Puerto Rico, and is a member of the Mont Pelerin Society.

Get our free exclusive report on our unique methodology to predict recessions