Slow Growth, High Government Debt

By Edgar Ortiz June 13, 2016

Translated from Spanish by Robert Goss

This article is an excerpt from the report on Mexico that can be found here.

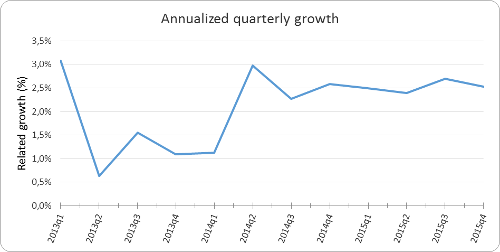

Mexico continues to experience a yearly growth of less than 3%. Since the second half of 2014, growth rate in Mexico has been stagnant and predictions are that growth will continue at a slow pace throughout this year, as well.

Graph 1

Source: Inegi

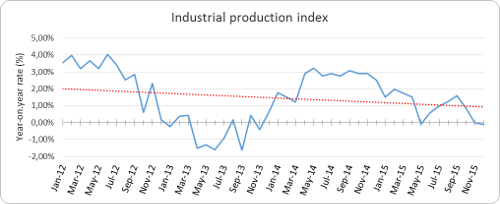

The industrial sector is one of most importance for the Mexican economy and is showing no signs of an upswing any time soon. This is a good measure of the lag in growth for the economy of Mexico in general. If it is the case that credit has experienced an increase in the last quarter – in both the business sector and for households – the increase has been a humble one.

Graph 2

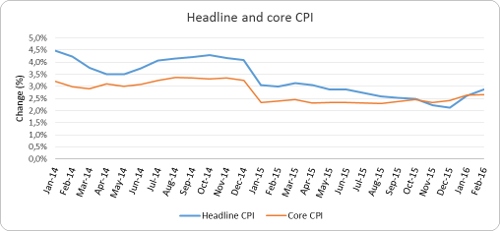

At the close of 2015, inflation reached an historic low of 2.3%, its lowest in 46 years. The drop in prices of energy and other commodities has provoked a downward trend in retail prices. As the reader can see in the following graph, inflation remains at low levels, especially in Mexico.

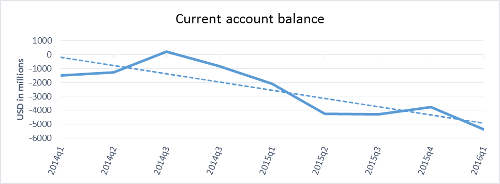

The external sector of Mexico doesn’t stand out with flying colors, either. The trade deficit is still a lingering problem and has shown an inability to stabilize. Two important exports for Mexico are oil and manufacturing. The drop in oil prices has caused a drop of more than 40% in the exportation of oil in 2015 and the effects are clear upon analyzing the balance of trade in Mexico.

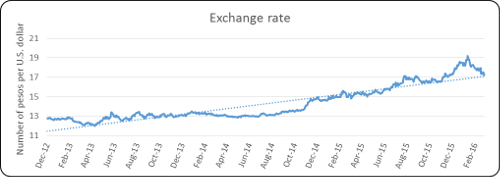

The exchange rate has suffered a significant depreciation since 2014. One explanation is that of the trade deficit, but another explanation is that of capital outflow in emerging markets, such as is the case in Mexico. Both factors have contributed to the change in value of the Mexican peso, which was valued at 13 pesos to the dollar in June of 2014 and 17.23 in March of 2016.

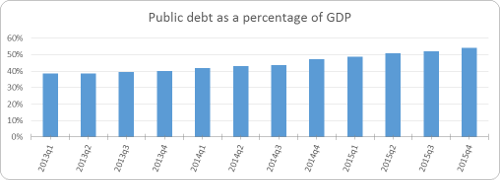

The government has been a major player in increasing debt by 10 percentage points since 2013, when the debt as percent of GDP was at 44% for the close of 2015 and a debt-to-GDP ratio of 54%. What is of most concern is that this debt has served primarily as a way of financing current expenditure. Bread for today, hunger for tomorrow.

Graph 6

Source: Self-prepared using data from Inegi

More information on the economy of Mexico can be found in our Market Trends reports.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions