The Poor Economic Criterion for a Remittance Tax

With the persistence of the new president of the United States to build a wall and his expectation to make Mexicans assume the cost, new creative initiatives to find a way to make them pay it are starting to emerge. Such is the case of the recent statement by Republican Congressman Mike Rogers to impose a two percent tax on remittances. Although the Congressman claims this initiative would only affect remittances headed to Mexico, how much longer will it be until this measure is also applied to other Latin American countries? According to the World Bank, since 2015 Guatemala has become the country with the second highest foreign exchange earnings Latin America and the Caribbean because of remittances, only surpassed by Mexico. Therefore, it wouldn’t be strange if this tax were to be applied to remittances destined to Guatemala as well.

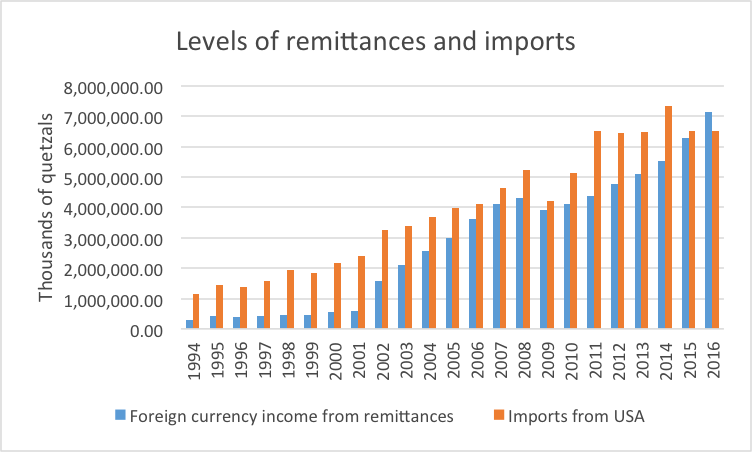

President Trump’s eagerness to make America great again has not allowed him to see the adverse consequences that his actions could cause. Imposing a remittance tax means sending the money becomes more complicated and lowers opportunities for international trade. While it is true that remittances represent more than 10% of Guatemala’s GDP, this is not a zero-sum game. Just as remittances introduce foreign currency to the Guatemalan economy, American products also enter the country in equal or greater proportion than remittances. Graph 1 shows that, with the exception of 2016, imports have been higher than remittances. In other words, more has been returned than what has been obtained from the American economy.

Why did remittances exceed imports in 2016?

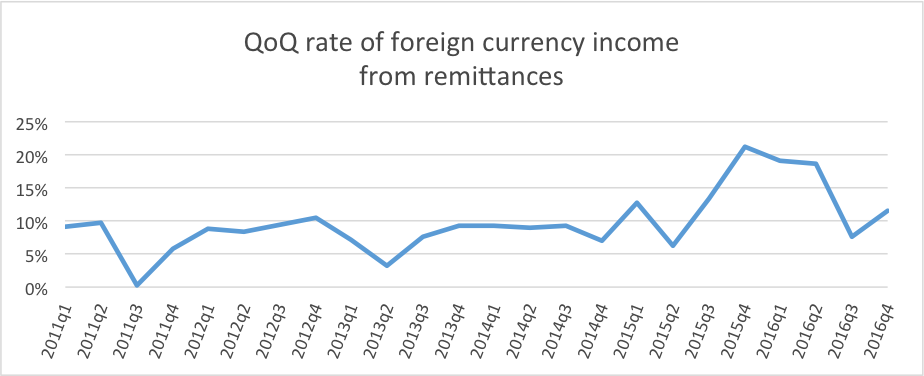

The US presidential elections were held in 2016, and by the end of 2015 the Republican Party candidate began his campaign promoting a wall along the border in order to stop immigration to the country. It didn’t take long for the this possible scenario to generate a reaction that was reflected in numbers. Graph 2 shows the sharp growth since 2015 in the inflow of foreign exchange earnings from remittances in Guatemala. Most likely, many thought the most logical thing to do was to send the money they could while it was still possible; there was a possibility that Trump could win the elections and carry out what he was promising. And it happened. Trump’s own words provoked the actions of the agents led on by these speculations: remittances increased while imports remained constant. This is the erroneous justification for the remittance tax: money generated in the United States in fleeing the country without returning. Yet this argument ignored the value generated to make these earnings possible.

What is that value?

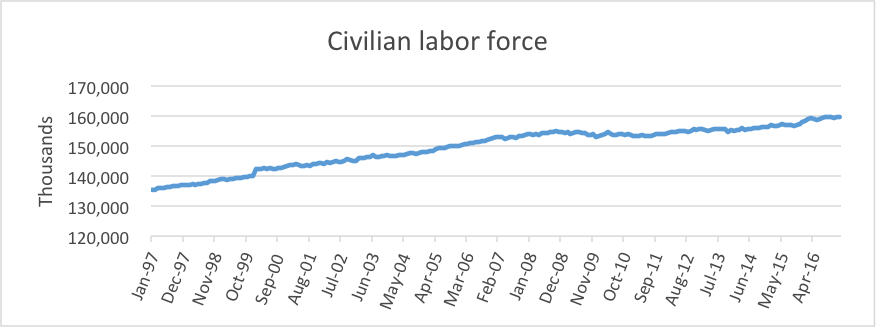

The argument that immigrants steal jobs from Americans has become ever more popular, yet the country’s workforce continues growing year after year, as shown in graph 3. There isn’t a fixed amount of jobs offered. Labor is a factor of production. This means that more will be required if there is a greater demand for goods. The supply of workers increases with immigration, but immigrants do not offer their services without consuming anything. As they supply labor, they also demand; therefore both labor supply and demand will increase in different proportions. Furthermore, competition encourages the improvement of skills and abilities, and increases each worker’s efficiency in order to increase their employment opportunities and improve their wages.

Therefore, the entry of immigrants into the US labor market encourages those who want to remain in the market to improve. Through competition, this process eliminates mediocre workers that do not contribute to the improvement of production efficiency, which fail to generate greater profits.

Remittances are not an outflow of American wealth; remittances are profits produced by an exchange that generates bilateral benefits. Immigrants offer their work—relatively cheaper and more efficient—in exchange for a compensation arranged to his or her liking. Part of this compensation goes to the worker’s family members, friends, and loved ones in their home country, which use the money on consumer goods or investment that could come from the United States. With the previous argument it is clear that remittances return more than what they “take away” from the United States. Implementing a remittance tax will not only impede the United States to recover its greatness, but it could also stagnate the country’s economy by closing borders and discouraging free trade.

Get our free exclusive report on our unique methodology to predict recessions

Estefanía Luján Padilla

Estefanía Luján has a degree in Economics with a specialization in Finance from the Francisco Marroquín University. She has attended to summer seminars from the Institute Juan de Mariana and from the Institute for Humane Studies. At Universidad Francisco Marroquín, she was a teacher assistant of courses from Henry Hazlitt Center as well as from the School of Economics, where she is also the Directors Assistant of Economics.

Get our free exclusive report on our unique methodology to predict recessions