Has the United States Recovered from the Recession?

By Clynton R. López May 5, 2016

Translated from Spanish by Robert Goss

Perhaps the most important theoretical topic concerning the economy as a discipline is attempting to explain the idea of economic cycles. In practical terms, an economic cycle is understood as being a periodic fluctuation in national income, employment and prices. Successful, and sometimes not so successful, attempts at an explanation have been made in both the media and academic worlds. Perhaps the one that stands out the most is the one offered by John Maynard Keynes. His rivalry with F. A. Hayek is a classic case of the causes and solutions to economic cycles.

In addition to explanations offered by the Austrian School of Economics and Keynesianisms and its derivatives, there are other intellectuals that have made an attempt at providing an answer to the causes, conditions and solutions of the economic cycle. Among them in the twentieth century are Milton Friedman and L.V. Mises himself. If we take a look at the past, we encounter other very plausible explanations, as well, such as the one given by Thomas Tooke in the nineteenth century from the perspective of ideas stemming from the Bank of England.

Within a less theoretical, and perhaps more practical realm, that of stock traders, there exist other explanations in today’s day and age. Possibly the most predominant characteristic of these practical theories is the fact that they are purely empirical, descriptive and, in a way, historicist. In other words, they renounce any theory based on the philosophy of history and instead focus on concrete conditions that result during certain stages of the cycles. The repetition of these conditions does not intend be able to be explained with any timeless metaphysical theory.

Perhaps the most well-known of these theories is that of Kondratiev’s famous long wave cycles which, although theoretical, is used today as very practical. In this same manner, we can discuss Clement Juglar’s theory that discovered and statistically “proved” certain regularities in the economic cycles and that one phase succeeds another. These phases have certain characteristics that, upon identifying them, tell us in which phase of the cycle the economy currently finds itself. Analyzing these practical concepts in a loosely hermeneutic fashion, we can try to determine the point in which the economy of the United States currently finds itself after the financial crisis of 2008.

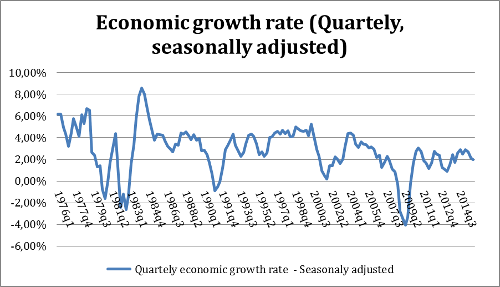

Graph 1

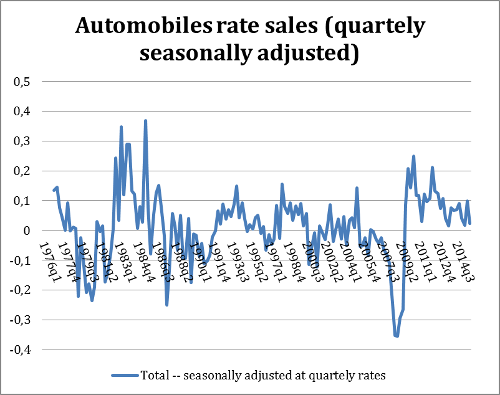

The theories on economic cycles that have been designated as being practical are those that focus on the characteristics that different economic agents represent during distinct phases of the cycle. For example… What kinds of goods are economic agents purchasing or not purchasing during different phases of the cycle? What did Americans stop buying during the 2008 crisis? During other crises, what did they stop buying? In these studies, a myriad of variables were analyzed, and not all gave repeated results as expected throughout history. One very important variable, which seems to follow expected regularity, is the sale of automobiles in the United States.

Graph 2

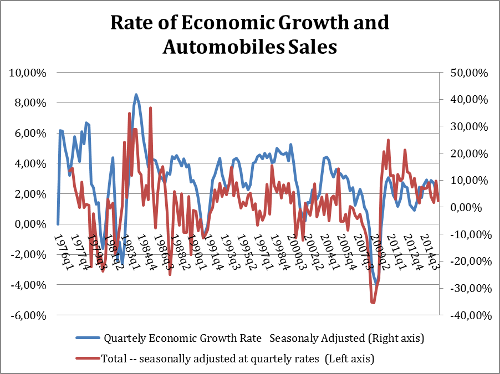

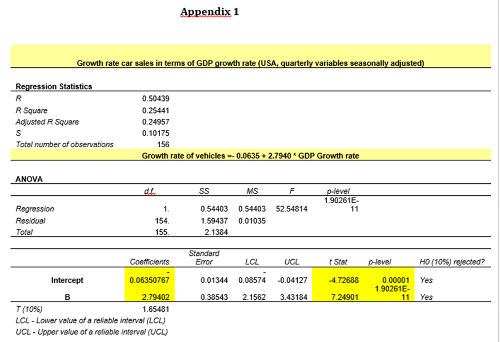

As we see in Graph 3, increases and decreases in trends in economic growth manage to adjust quite well and evidently without delay. En Appendix 1, a simple regression is seen between the growth rate of automobile sales explained by GDP growth rate (both quarterly and seasonally adjusted). The results are statistically valid and the change in GDP explains the approximate 50% change in sales.

Does this mean that economic crises experienced in the United States can be explained and predicted by analyzing automobile sales? Certainly not. But it can be said that automobile sales is a pro-cyclical variable that responds practically on par with positive and negative U.S. GDP growth. It is very probable that this is because of the way that GDP is calculated and also because it is most likely an elastic variable linked to peoples’ incomes.

Has the United States recovered from the economic recession? Probably not. Obviously, the United States is not currently still experiencing a recession, but nor does it find itself in a phase of expansive economic growth. Moderate growth rates would imply that it is in a recovery stage and, if things are done well, it could mean that the foundation is being set for an expansive phase of growth in the cycle. How much stock can be put into empirical theories of the economic cycles? From Sigmund Freud and the Institution of Psychoanalytic Knowledge during the first half of the twentieth century, it is known that mental satisfactions are unique and specific. Let’s leave it to the stock traders to decide.

Graph 3

Get our free exclusive report on our unique methodology to predict recessions

Clynton López

Clynton López is a professor at the Francisco Marroquín University since 2002 in the areas of economics and philosophy. He has a degree in Economics with a specialization in Finance from the Francisco Marroquín University and a master in Economics from the same university, both Magna Cum Laude. He studied executive programs at Boston University on Managerial Economics & Corporate Finance, the Master of Philosophy at the Rafael Landívar University (specialization in phenomenology), and the Post Graduate Degree in INCAE for Senior Management. In the professional field he has more than 10 years of management experience in banking and financial companies in Guatemala, California and Puerto Rico, and is a member of the Mont Pelerin Society.

Get our free exclusive report on our unique methodology to predict recessions