California and Puerto Rico: Debt Restructuring? Greece?

By Clynton R. López F. July 13, 2015

Creditors of private and government debt generally perform credit analyses, first to grant a loan or purchase bonds, and then eventually to evaluate debt restructurings. The first factor to be considered when evaluating a potential credit is the borrower’s capacity to pay. The second factor is the collateral available to secure the loan, especially in the case of long-term financings. The third factor, no less important than the first two, is the borrower’s willingness to pay. This order becomes inverted when evaluating a debt restructuring. The first thing considered is the borrower’s willingness to pay, followed by the collateral (especially since the probability of default is theoretically higher in such cases), and lastly the capacity to pay (which is low, by definition, in the case of restructuring). This introduction will help us consider the cases of California and Puerto Rico, both of which face the possibility of requesting debt restructuring.

California, the state with one of the largest economies in the country, and Puerto Rico, a commonwealth of the United States. Which should have its debt restructured? It’s important to begin this analysis knowing that if debt is not restructured when requested by a creditor (private or public), there would probably be an immediate problem. Restructuring provides additional time to find future solutions to a current problem, although it may only delay the inevitable.

California’s 2014 GDP per capita (in chained 2009 dollars)[1] was USD 54,462, while its debt per capita was USD 10,927, resulting in a ratio of debt-to-GDP of 20%. On the other hand, Puerto Rico’s GDP per capita (in chained 2009 dollars)[2] was USD 27,202, with debt per capita at USD 20,818, a ratio of debt-to-GDP of 77%.

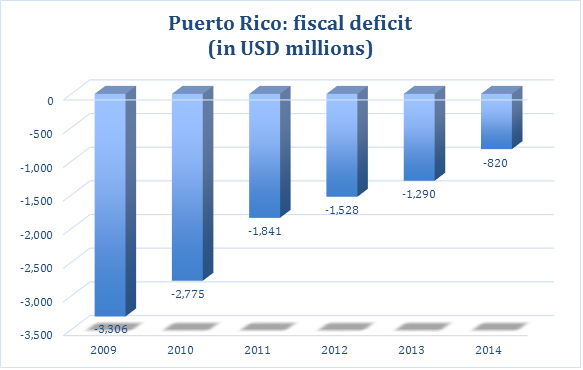

If we were to perform a debt restructuring analysis for each, we would begin by considering the borrower’s willingness to pay. This is not an easy task. We would rely primarily on signs that may indicate willingness to pay, such as historical debt repayment record and recent financial conduct. In 2008 both faced deficits: California at a record high USD 42 billion and Puerto Rico at USD 3.3 billion (see chart). Surprisingly, California today faces a surplus of USD 850 million, while Puerto Rico continues to maintain a deficit. While both have reduced their deficits over the last years, California has done so to a far greater extent, perhaps an indication of a stronger willingness to pay. In terms of the second factor, collateral, both could offer securitization of relatively stable future revenues. However, California’s collateral would be better because it has a growing population and expanding GDP, while Puerto Rico has a declining population and falling GDP. Lastly, in terms of capacity to pay, California is in a stronger position with a 20% ratio of debt-to-GDP (in per capita terms), compared to Puerto Rico, which is in a more compromising position with a ratio of 77%. While both are candidates for debt restructuring, based on these figures there is greater probability that creditors would accept restructuring for California.

How do they compare to Greece? The case of Greece is very different. For starters, it has already requested its third bailout. Without running numbers on its restructuring, we can simply consider the first factor, its willingness to pay. Recent government actions cast reasonable doubt on the willingness to pay of current Greek officials. Under normal market circumstances (not political), it would be likely that such actions would result in creditors rejecting a debt restructuring.

Source: Commonwealth of Puerto Rico: FY 2014 Budget and Other Recent Developments

[1]. Prepared with data from http://www.bea.gov and https://www.census.gov.

[2]. Sources for GDP per capita: ERS International Macroeconomic Data Set and Instituto de Estadística de Puerto Rico.

Get our free exclusive report on our unique methodology to predict recessions

Clynton López

Clynton López is a professor at the Francisco Marroquín University since 2002 in the areas of economics and philosophy. He has a degree in Economics with a specialization in Finance from the Francisco Marroquín University and a master in Economics from the same university, both Magna Cum Laude. He studied executive programs at Boston University on Managerial Economics & Corporate Finance, the Master of Philosophy at the Rafael Landívar University (specialization in phenomenology), and the Post Graduate Degree in INCAE for Senior Management. In the professional field he has more than 10 years of management experience in banking and financial companies in Guatemala, California and Puerto Rico, and is a member of the Mont Pelerin Society.

Get our free exclusive report on our unique methodology to predict recessions