Argentina Exits Default and Returns to the Global Market

By Edgar Ortiz May 30, 2016

Translated from Spanish by Robert Goss

Last Friday, the government of Argentina paid off $6.3 billion dollars to holdouts to put an end to the partial default that has left them out of the global market.

Since the end of 2015, a certain optimism was being perceived by investors given that both Scioli and Macri, during their campaigns, demonstrated a willingness to find a solution to the default. In February of this year an agreement was reached with the holdouts and payment was finally made to creditors. The agreement lifted the precautionary measure dictated by judge Griesa that prohibited payment to other creditors.

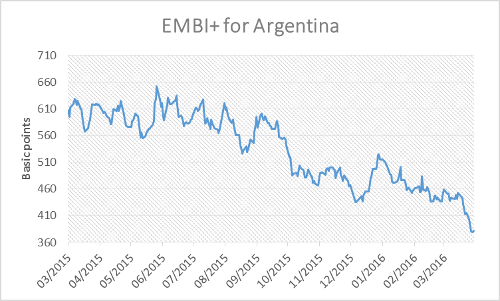

The effect of this has been seen in the performance of Argentina’s debt in the EMBI+, which has shown major improvement for one year now. Using basis points, the EMBI+ measures the difference between bond performance in emerging countries and American treasury bonds, Eurobonds and other risk-free economic instruments.

Source: Bloomberg

A year ago, its rating was above 600 basis points and on April 22 of 2016, it was at 382 points. In turn, Moody’s raised its rating and placed it in B3. One must note that apart from exiting default, other key measures have been taken, such as lifting currency controls and other austerity measures implemented by the new government.

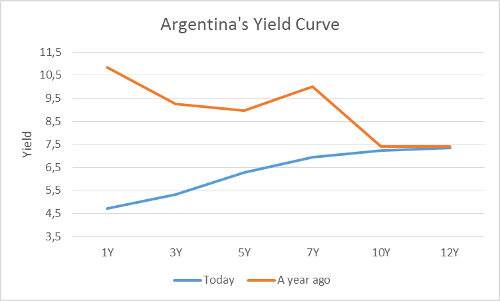

Argentina’s return to the global market has produced excellent results. The government was able to place USD$16.5 billion at an average 7.2% interest rate. This may seem relatively high compared to others in the region, but it is much better than what was being speculated by some only weeks ago. Some analysts had expected an 8% interest rate given the situation in Argentina. The measures taken have made the credit less expensive in comparison to last year.

Source: Bloomberg

Certainly, there exists a large margin for improvement, but the main challenge for Argentina was to earn credibility. There is no doubt that the aforementioned measures taken have opened the path allowing for Argentina’s return to the global market. Nevertheless, given its history of defaults and its weak institutionalism, it will be difficult to generate confidence for investors, therefore it must first be demonstrated that these improvements are sustainable and not only provisional.

The Global Competitiveness Index published by the World Economic Forum states that the biggest weaknesses facing Argentina are its poor institutional quality and its macroeconomic environment. The WEF places Argentina at 135 of 140 for institutional quality, and for macroeconomic environment it is placed at 114 of 140 countries.

There exist many aspects for which Argentina must improve macroeconomically, and without a doubt, inflation is one of them. Even considering the changes put in place by the new government, year-on-year inflation continues to be at 30%. One would hope that with its return to the global market, Argentina’s central bank will put an end to debt monetization and inflation will see improvement, undoubtedly the problem of most concern currently facing Argentina.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions