Mexico: Petroleum and Public Finance

By Edgar Ortiz February 2, 2016

Translated from Spanish by Katarina Hall

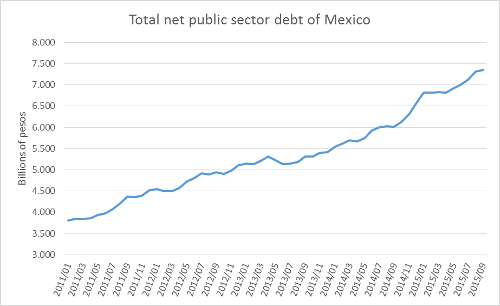

Public debt is an increasingly important issue for Mexico. Between January 2014 and December 2015, Mexico’s public debt grew 33%.

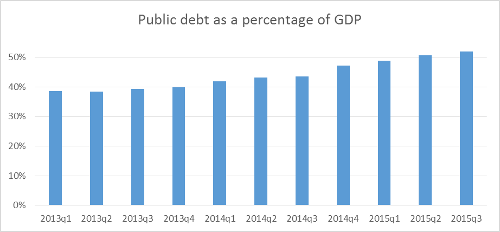

As Mexico’s debt to GDP reaches 52%, authorities continue to downplay the debt’s importance by pointing out that the debt level is still below that of similar nations. A poor consolation. Below is the debt’s change as percentage of the GDP.

The debt’s rise from 39% to 52% is not the most worrying thing for Mexico. Mexican public spending has not reflected the county’s increasing economic growth. Whether because of the current expenditure or the poor controls encouraging waste, Mexico finds itself in a difficult situation to overcome: more debt, low economic growth, and little increase in tax revenues to cover debt levels.

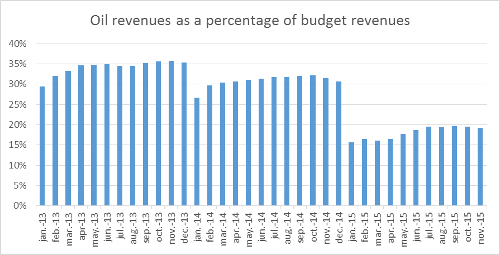

Mexico has been very comfortable financing part of its budget with oil revenues. Nonetheless, the drop in oil prices has directly and aggressively impacted Mexico’s treasury.

Two years ago, oil financed up to a third of Mexico’s annual budget. Nowadays, it cannot even cover a fifth part of the country’s budget. This gap was covered with public debt. The problems Mexico must address cover three major themes:

First, oil will not recover to prices that exceed $100 per barrel—at least not in the next year. If oil prices were to return to those levels, they would do so gradually.

The second theme is the Fed’s interest rate raise. The Fed’s decision sent a signal that interest rates will rise gradually but steadily. This is bad news for a country in debt: refinancing will be at higher interest rates. Mexico could have problems if it plans to accommodate its future budget with high debt levels, and could face problems if it wished to engage in future debt.

Third, low oil prices affect Mexico’s trade balance, and with it the already deteriorated exchange rate of the Mexican peso. In 2014, oil represented more than 10.5% of Mexico’s exports. Today, it only represents 6.3%, maintaining the trend toward a depreciated peso and an expensive external debt.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions