The Justified Appreciation of the Quetzal

By Estefanía Luján Padilla March 31, 2016

Translated from Spanish by Katarina Hall

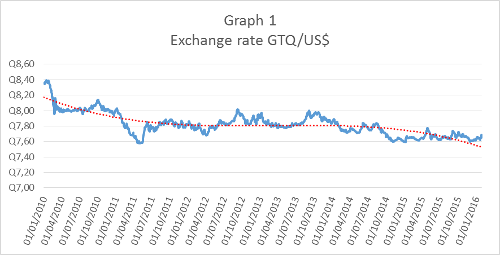

Since January 25, there has been constant speculation about the possible devaluation of the quetzal (Q). After Julio Héctor Estrada, who is part of the Monetary Board, was appointed Minister of Finance warning signals about the currency’s devaluation set off in the country’s financial sector. Most alarming, however, is how Guatemala’s Association of Exporters (Agexport)—with whom the minister has close ties—is pressing for an exchange rate of Q8 to the dollar. According to the union, there is an overvaluation of the quetzal; in other words, an undervaluation of the dollar in the country. Graph 1 demonstrates how the quetzal has appreciated against the dollar since January 2010, reaching Q8.39 to the dollar. However, this does not mean an overvaluation of the quetzal. All other economic activities, both formal and in formal, make up the appreciation of the quetzal.

Guatemala’s exchange rate is recognized for not being established by arbitrary political decisions, but on the supply and demand of foreign currency. This limits the intervention by the Central Bank of Guatemala (Banguat) in the buying and selling of currencies to “counteract speculative, cyclical, or stationary movements in exchange rates.” Thus demonstrating how exchange rates are affected by foreign currency earnings, and by formal and informal commerce. Each of these determine the quantity of dollars and quetzales circulating in the economy, reflecting the currencies’ supply and demand.

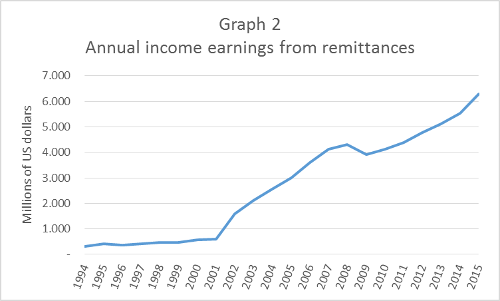

The dollar price is not only affected by Banguat’s intervention in the buying and/or selling of dollars, but it is also affected by family remittances. This happens especially in Guatemala, where foreign currency earnings represented approximately 27.3% of the GDP in 2015. Furthermore, graph 2 shows how foreign currencies that come from remittances have increased each year, and have increased exponentially since 2009. This means there are relatively more dollars in the Guatemalan system, lowering the price of the dollar to the quetzal.

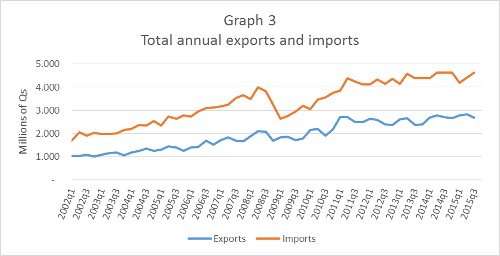

As the price of the dollar decreases, the price of imports also decreases because more foreign products can be bought with fewer quetzales. Imports should be rising, and in fact, this is the current trend. Graph 3 shows how exports and imports have increased over time. However, imports have increased faster than exports, as the prices for main import products have decreased faster than the prices of exports. This makes imports more profitable (more details about import and export prices can be found in our next report on Guatemala). Aside from formal import and export markets, economic activity in informal markets—such as contraband, smuggling, and drug trafficking—also generate a dollar flow in the Guatemalan economy.

With these factors in mind, are exporters justified when trying to maintain the price of the dollar to Q8 because of the currencies overvaluation? No. They would not have the economic support of supply and demand, because Guatemala’s monetary policy determines exchange rates with the help of the variables previously presented. Of course, this decision could also become political and arbitrary, justified as “protecting national product,” but that would be a topic for another paper.

Get our free exclusive report on our unique methodology to predict recessions

Estefanía Luján Padilla

Estefanía Luján has a degree in Economics with a specialization in Finance from the Francisco Marroquín University. She has attended to summer seminars from the Institute Juan de Mariana and from the Institute for Humane Studies. At Universidad Francisco Marroquín, she was a teacher assistant of courses from Henry Hazlitt Center as well as from the School of Economics, where she is also the Directors Assistant of Economics.

Get our free exclusive report on our unique methodology to predict recessions

Interesting article, and especially helpful because it is so difficult to find topical (english-language) discussions of the Guatamalan economy.