Are Guatemala’s Public Finances Sustainable?

By Edgar Ortiz October 19, 2015

Translated from Spanish by Andrés Contreras

The media often report that Guatemala’s current financial situation is stable. We often hear boasts that the country’s public debt to GDP is low compared to other countries in the region. However, despite these claims, government finances have not followed a course that would make us optimistic.

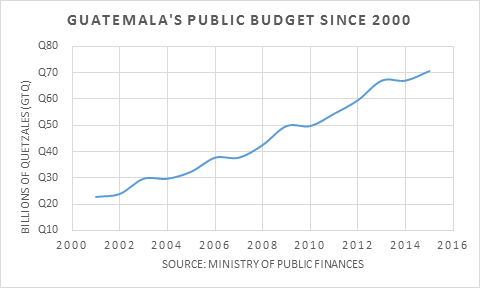

Beginning in 2000, public expenditures have begun to grow at a faster rate, as seen in the graph below.

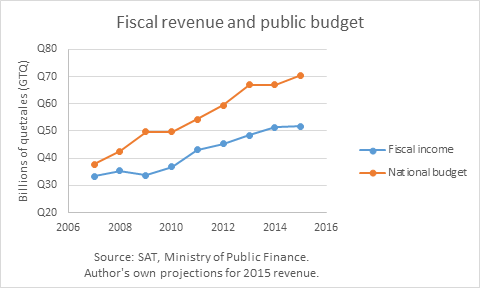

Fiscal revenue has also increased significantly over the same period. However, in the last five years, the gap between revenue and expenditures (i.e. fiscal deficit) has widened.

In 2012, the government approved fiscal reforms that supposedly would increase its revenues. However, the evidence shows otherwise. Similarly, the 2015 fiscal budget included an increase in three tax rates, but these were suspended through loopholes. This has resulted in revenue estimates for 2015 that are lower than those stipulated in the fiscal budget approved in November 2014.

Going back to the main point, isn’t Guatemala one of the countries with the lowest public debt to GDP levels in the region? Its public debt currently stands at 25.9% of GDP. Is this low? Certainly it’s nowhere near the levels seen in El Salvador (56% debt to GDP) or Argentina (45% debt to GDP). Nonetheless, Chile and Peru have lower ratios at 15% and 20%, respectively. Compared to countries that are doing it right, Guatemala does not stand as one of the least indebted in the region.

To better judge Guatemala’s current financial situation, we must make two observations. First, the relevant metric to consider should be fiscal revenue to GDP and not public debt to GDP, since fiscal revenue is the resource that the government effectively generates to cover its obligations. In this case, we find that public debt is 228% of fiscal revenue. It has stayed above 220% since 2012.

Second, rarely is there any mention of the debt that the government has with social security and the Bank of Guatemala for its operating deficits (see UFM Market Trends Guatemala report for the first quarter of 2015). Adding these debts to the public debt levels mentioned earlier, the figures become more shocking: public debt would stand at 36% of GDP and at 322% of fiscal revenue.

Institutions such as the International Monetary Fund (IMF) consider risk to be the point at which a country’s public debt reaches 250% of fiscal revenue. Taking into account the Guatemalan government’s debt to social security and the central bank, that figure has been widely exceeded. Are Guatemala’s public finances really sustainable?

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions