What Can We Expect From the Guatemalan and Global Economy?

By Clynton R. López F. September 7, 2015

Translated from Spanish by Daniel Contreras

Historically, the Guatemalan economy has had low volatility. For the past twenty years, the average growth rate has been 3.5%.[1] This level of volatility is generally lower than that of the other economies in the region. However, as the country suffers its worst political crisis since 1993, the question on everyone’s mind is, Will the political crisis affect the economy? To answer this question we first need to take a look at some microeconomic data.

According to the export index calculated in the UFM Market Trends 2015 first quarter report, Guatemala’s principal exports are sugar, banana, coffee, and textiles. After the worldwide commodities bubble affected basically all commodities, the international price of sugar currently sits at 2006 levels, almost one third of what the price was in 2012. Prices for natural rubber, another important export, are currently 20% lower than they were in 2011.

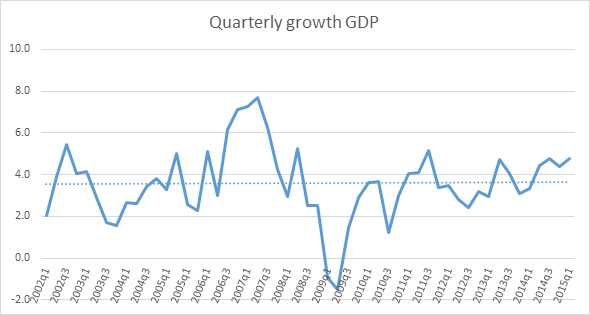

The macroeconomic data, however, tells a slightly different story. Graph 1 shows Guatemala’s annual quarterly GDP growth since 2001. The trendline is almost horizontal, indicating that growth for the past fifteen years has been stable at just over 3.5%.

Graph 1

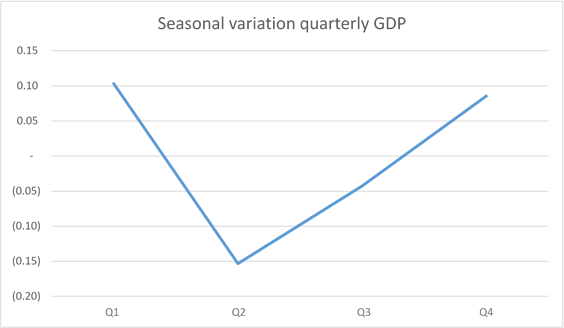

In Graph 2, we see the seasonality calculated by the quarterly reports of Guatemala’s GDP. We can clearly see that average volatility in Guatemala’s GDP is practically negligible. Not even the positive seasonality in the first and fourth quarters or the negative seasonality in the second or third quarters reach a two decimal difference. Unfortunately, quarterly GDP data for Guatemala is delayed six months, but based on the information published for the first quarter of 2015 we can assume that the macroeconomic data will remain the same. Microeconomic export data tells a different story. UFM Market Trends will delve deeper into this in our second quarter report as we take a closer look at the current economic situation in Guatemala and how it reacts to the political crisis.

Graph 2

What can we expect from Guatemala and the global economy? Aside from important economic developments in other parts of the world, the Guatemalan economy continues to be closely tied to the performance of the US economy. On August 27, the Bureau of Economic Analysis published its revised numbers for real GDP growth in the US during the second quarter of 2015. Real GDP was revised up from 2.3% to 3.7%, 1.4% higher than estimates. The 3.7% figure is a significant increase over the 0.6% real GDP growth experienced during the first quarter of 2015. (These figures also point to Guatemala’s relative stability in terms of GDP.)

Independently of China’s economic deceleration, the EU’s sluggish performance, and Japan’s continual QE failures, an accelerated US GDP growth would be welcome news for Guatemala. All these subjects will be explored in greater detail in the UFM Market Trends second quarter report for 2015.

[1] Data obtained from Guatemala’s central bank.

Get our free exclusive report on our unique methodology to predict recessions

Clynton López

Clynton López is a professor at the Francisco Marroquín University since 2002 in the areas of economics and philosophy. He has a degree in Economics with a specialization in Finance from the Francisco Marroquín University and a master in Economics from the same university, both Magna Cum Laude. He studied executive programs at Boston University on Managerial Economics & Corporate Finance, the Master of Philosophy at the Rafael Landívar University (specialization in phenomenology), and the Post Graduate Degree in INCAE for Senior Management. In the professional field he has more than 10 years of management experience in banking and financial companies in Guatemala, California and Puerto Rico, and is a member of the Mont Pelerin Society.

Get our free exclusive report on our unique methodology to predict recessions