The Fed’s Policies and their Consequences for Mexico

By Edgar Ortiz June 16, 2016

Translated from Spanish by Robert Goss

As mentioned in a previous article, on December 16 of 2015 the Fed announced a rate hike of 0.25 percentage points and Mexico’s central bank followed suit the very next day. The decision seemed logical considering that the peso was not ceasing to depreciate and a rate hike in the US would make it more attractive for capital to move there. In fact, an outflow of capital is an expressed concern for Augustín Carstens, governor of the Bank of Mexico.

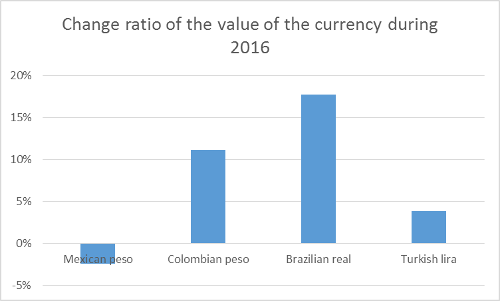

Widespread expectations and the Fed have signaled that increases in interest rates will continue gradually. The Bank of Mexico acted in advance and implemented an increase in its reference rate in February raising it from 3.25% to 3.75%. Also, during the same month, the Bank of Mexico initiated a foreign exchange intervention as an attempt to subside the depreciation of the peso. All that said, the peso continues its downward trend and, compared with other emerging markets, is the currency that has shown the most depreciation thus far this year.

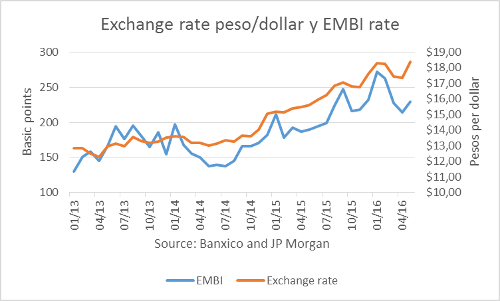

Why is this the case? In addition to experiencing problems in improving exportation levels, rate hikes in the United States make it so that capital is more attracted to areas where higher yields are offered causing them to seek better returns outside of Mexico. Also, though, this provides confidence for investors to sell short against the peso. A BBVA-Bancomer report shows that since July of 2015 short positions against the peso are at very high levels. Similarly, this is tied to the perception that there exists a sovereign debt risk for Mexico, which also puts pressure on investors to go against the peso. The topic of government debt was of special interest in our 2016 first quarter report on the Mexican economy. Below, we show the change in EMBI (Emerging Market Bonds Index) and the peso/dollar exchange rate.

We see here that the exchange rate has changed in response to the perception of country risk that is reflected by the EMBI rate. A minor exception can be seen from the middle of 2014 to the end of 2014 where depreciation was due to the pronounced drop in oil prices more so than being due to a country risk factor.

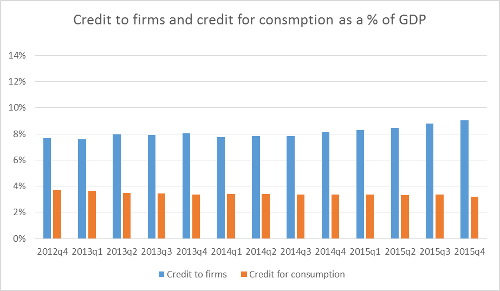

What’s more, the increase in interest rates implemented by the Fed and the resulting outflow of capital from Mexico may begin to affect the good pace in credit growth in the country. As we will see in the following graph, credit to firms has spiked for the last few quarters and is at 9% of the GDP. The latent risks are that the outflow of capital causes a lack of funding for Mexican companies, that it gives rise to an increase in interest rates, and that the rise in credit extended, which firms have enjoyed as of late, may experience a reversal. Credit for consumption remains somewhat low and its behavior is normal.

The situation is a complicated one for Mexico in the medium term. Perhaps the decision made by the Fed does not come at the best time for Mexicans, and the rally may be coming to an end. Thus far, the Bank of Mexico’s response has not been one of much help. Despite foreign exchange intervention and despite raising the reference rate, it has been incapable of having any influence on the exchange and credit markets. Perhaps the Fed hasn’t gotten it exactly right either and rates are low simply because return on capital continues to be low and the rate hike penalizes the reallocation of resources. In any case, Mexico is a mere bystander and has no choice but to make adjustments based on decisions made by the Federal Reserve. What will slowly trigger an eventual crisis in Mexico will not be Banxico, but rather the Mexican government and its irresponsibility with ongoing indebtedness.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions