Brazil’s Accidental Growth Comes to an End

By Edgar Ortiz September 21, 2015

Translated from Spanish by Andrés Contreras

Many people thought Brazil was the poster child of economic success for its supposedly sound economic and social policies. It was seen as one of the most promising emerging economies in the world and, given its size, was expected to assume a leadership position on the global stage.

However, the last twelve to fifteen months have seen a total collapse of this great house of cards that had become Brazil. One of the factors for the country’s current misfortune is precisely the same one that led to its economic “success”: commodity prices.

Undoubtedly, Brazil made important progress in the 1990s under the leadership of Henrique Cardoso. Many inefficient state-owned companies were privatized and with that public spending was reduced. With these and other structural reforms, the country started on a path of relative economic liberalization, and it implemented a more sound monetary policy than it had in previous years.

These changes, although necessary, were not enough to generate a truly free and functional market. In spite of this, the Brazilian economy grew, primarily through the oil sector, with the discovery of new oil fields, and the production of other basic materials such as oilseeds, sugar, and minerals.

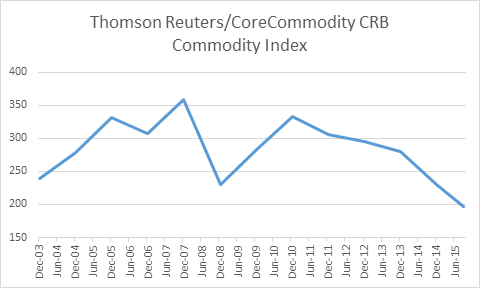

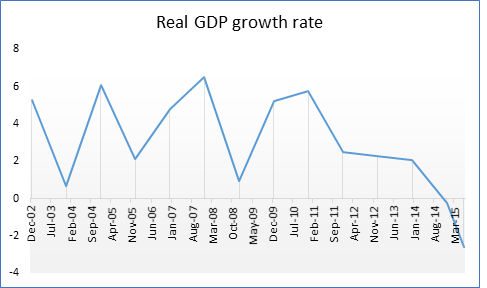

While commodity prices stayed at relatively high levels, the Brazilian economy posted acceptable rates of growth. Only 2010 saw growth rates far above the average. After 2012, commodity prices fell below pre-crisis 2008 levels and with them Brazil’s growth slowed.

A major setback was the dramatic fall in oil prices that began in mid-2014, which undoubtedly aggravated the Brazilian economy. Economic projections reflect a recession in 2015 and poor growth for 2016.

Source: Bloomberg

The key message is that Brazil never generated secular and sustained economic growth that would allow the country to capitalize on its productive structure. Rather, it exploited its natural resources at a time when the world was in an economic boom to the benefit of its economic growth rates.

Today, in addition to the major setbacks that resulted from lower commodity prices, there is also the falling demand for raw materials in China, a country that accounts for 17% of Brazil’s exports.

Monetary and credit policy in Brazil will require a special and separate article. Keep in mind that while many banks and other companies where privatized in the 1990s, the Brazilian government continued to hold on to several public banks that have been key players in the country’s credit markets.

Get our free exclusive report on our unique methodology to predict recessions

Edgar Ortiz

Edgar Ortiz has a degree in Law from the Francisco Marroquín University. He holds a master in Austrian Economics at the Rey Juan Carlos University in Madrid. He is the executive director of the Center of Economic and Social Studies (CEES). He is a professor of economics at the Francisco Marroquín University, and he is also an analyst on issues related to the situation at Canal Antigua. He works as an associate lawyer at Estudio Jurídico Rivera.

Get our free exclusive report on our unique methodology to predict recessions