Will China Reverse Its Trade Surplus with the United States?

The increasingly erratic trade tensions between the United States and China does not appear to be ending anytime soon. The US president affirms that the deficit in the current-account between the two countries will soon come to an end and attributes the deficit to the Chinese competing unfairly.

Along these lines, supposedly private conversations that have been leaked in recent months suggest that Xi Jinping’s government has a plan, consistent with Trump’s rhetoric, to reallocate the composition and flow of transactions of goods, services, and other components that make up the trade balance between the two countries by the year 2024.

The trade war sent global equities to the steepest losses of the year and just got a lot bigger after both sides announced more tariffs. This exchange of “fire” wiped out more than $1 trillion from stock values this week[1].

The obvious question is whether China possesses the flexibility for an undertaking of this magnitude. Apart from the fact that China’s trade surplus with the world is decreasing and the trade surplus with the United States is increasing (according to both countries’ accounting), there is a corporate-debt bomb and a real estate pricing bubble in China. As if that were not enough, the US federal budget deficit for the 2020 fiscal year is $1.1 trillion.[2]

This amounts to an unfavorable situation in which ever-increasing public debt in both economies and a fruitless exchange of rhetoric between leaders have done nothing but inject a dose of volatility into financial markets. This exchange has also given the impression that the two leaders are ignoring the accounting principles of the accounts that make up a country’s balance of payments.

Why Does a Trade Deficit Matter So Much?

A trade deficit is simply an accounting expression that reflects that a country imports more than it exports—nothing more. The opposite is a surplus. Later on, we will analyze the components of the current account and briefly discuss the capital account to explain why surpluses and deficits reflect only the different positions of participants in the global economy. Participants can be either creditors or debtors. Being a creditor does not imply economic growth, nor does being a debtor imply economic contraction.

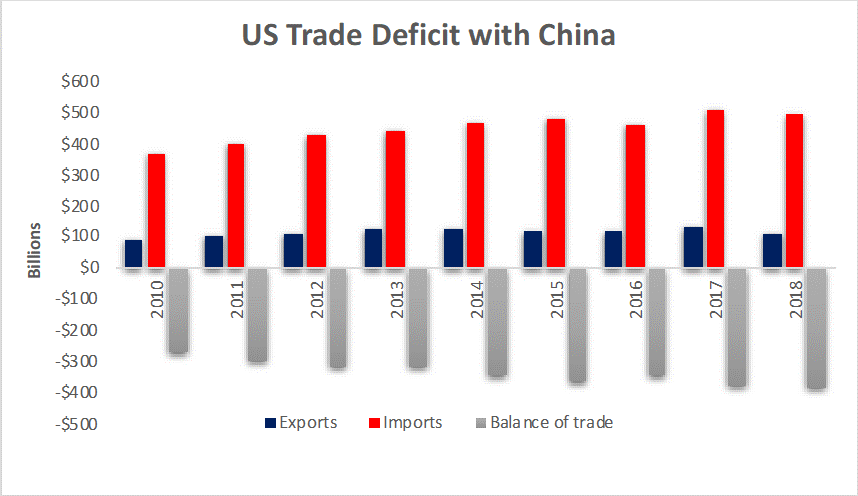

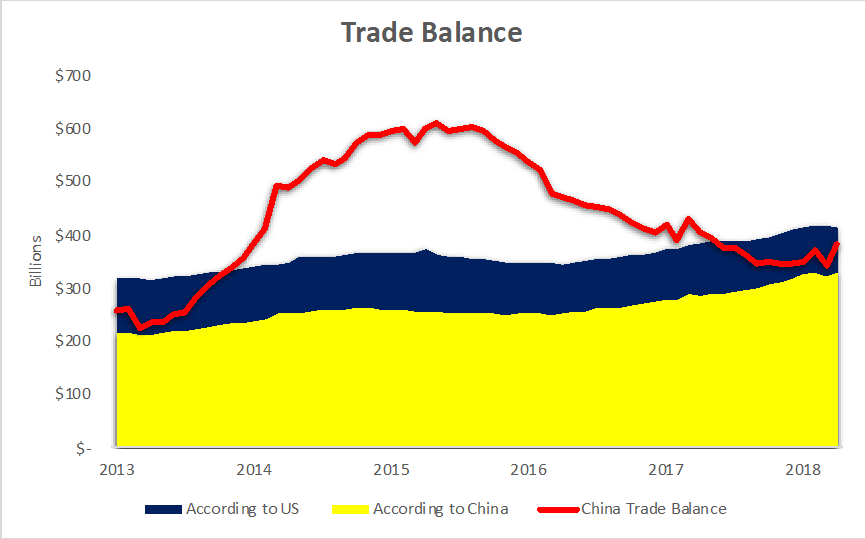

According to the United States, the US trade deficit with China is $382 billion.[3] To put this in context, this deficit is almost five times greater than the United States’ second-largest deficit, which is with Mexico.

Source: Prepared by the author with data from the US Census Bureau

Although Trump emphasized his “desire” to reduce the trade gap with China in his 2019 State of the Union speech, it does not seem that it will shrink in the short term. It increased 10.9 percent in the first eleven months of 2018 compared with the same period in 2017 ($37.6 billion in total). During the first year of the Trump administration (2017), the deficit increased by $28.6 billion—a record amount and especially striking if compared with the $20.3 billion reduction in the gap in 2016. The annual deficit has almost doubled since 2011. However, this figure does not include data from December 2018, which the Department of Commerce has yet to publish.

The question is how to correct the deficit. There are two options for China, neither of which is viable in the short term. One is less senseless than the other. The first option is for China to increase imports from the US by a factor of almost three on the condition that the flow of exports remains constant. The second is to increase the imports even more so that exports can continue at the current growth rate.

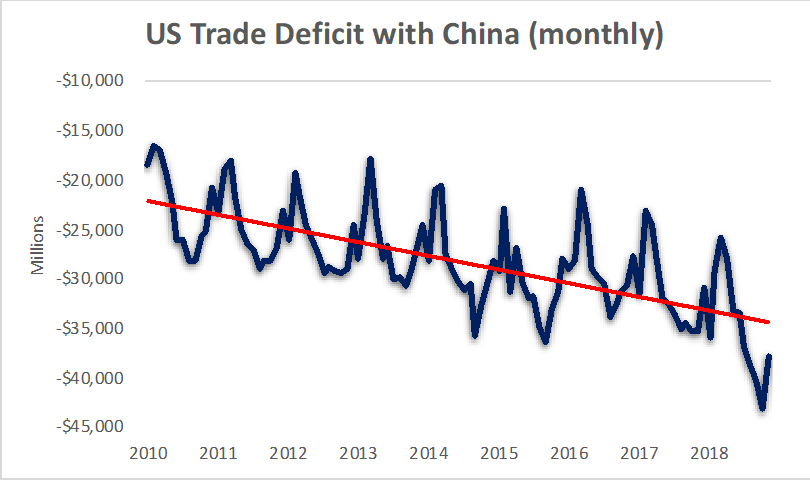

Source: Prepared by the author with data from the US Census Bureau

Chinese sources claim China has promised $600 billion in annual imports from the US in 2024. This figure is not trivial and reversing a trend that has lasted years is not a simple matter. The previous graph demonstrates how volatile the movement of the current account’s components can be from month to month, particularly with a trade war that affects the timetable and quantity of imports and exports between both nations.

Although the increase in imports is technically possible, the level of implicit sacrifices renders the proposal less feasible. If we closely analyze the most recent public data, it is evident that the US deficit is reaching historic proportions.[4] The imposition of tariffs on imported washing machines and solar panels in January of last year was the first evidence that China’s dominance over the global supply chain is a problem for President Trump’s agenda.[5]

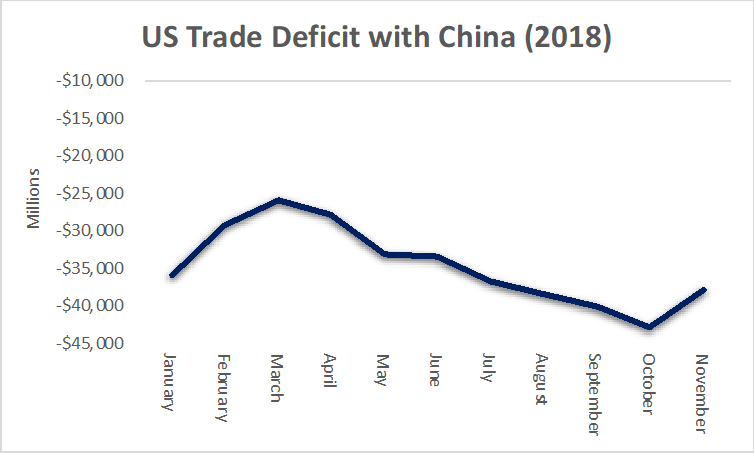

Source: Prepared by the author with data from the US Census Bureau

This was only the prelude to the approval of a new tax on March 9 of last year, this time on steel and aluminum coming from any country,[6] days after the deficit began to expand at a fast pace. On March 23, 2018, China responded with a tax on $3 billion of US imports including fruit, wine, dried fruit, and pork; later, on April 4 it introduced an additional 25 percent to the existing tax on 106 imported US products (soy, automobiles, chemical compounds, aircraft, and others). Besides, Beijing had offered only days earlier to cut the bilateral trade deficit by $50 billion. The reality is that China has a much narrower negotiating margin than the United States.

Figures in Context and Trade Instability

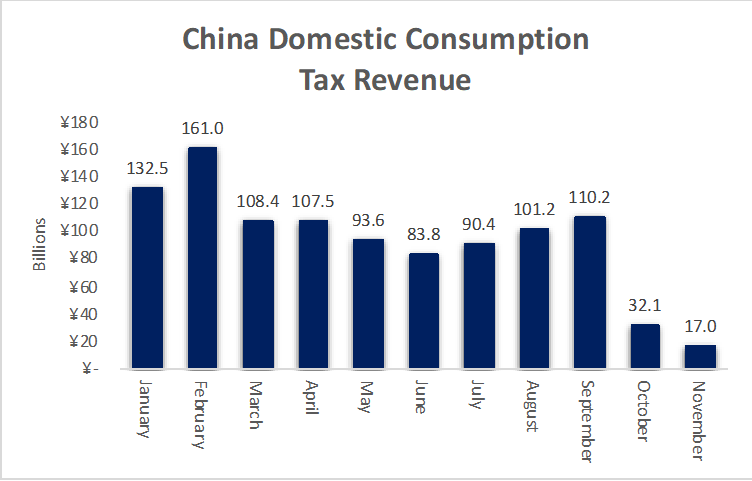

The possibility of new sanctions and the general uncertainty surrounding Trump’s apparently erratic decisions are affecting the negotiating climate of both countries. This is most striking in China. The general level of revenues from consumption taxes rapidly deteriorated throughout 2018. In November, they reached a historic low of 17 billion yuan ($2.5 billion).

Source: Prepared by the author with data from Bloomberg

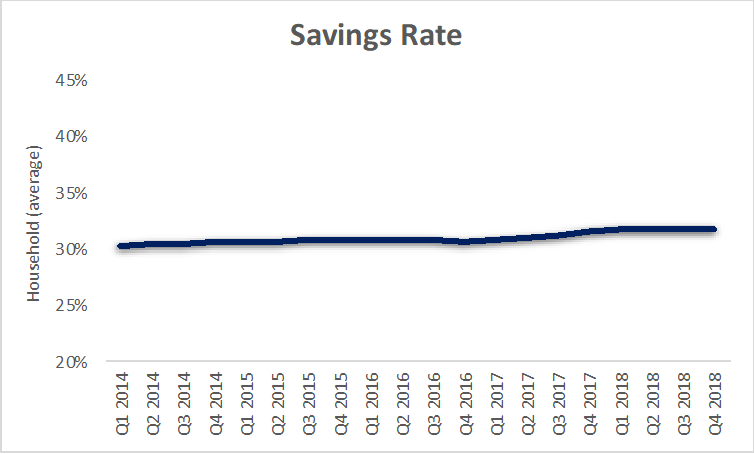

Of course, not all of this is due to Trump. Other factors have contributed to the trends. For example, China’s household savings rate peaked in 2018, at a remarkable 31.8 percent.

Source: Prepared by the author with data from Bloomberg

China has a trade surplus with the world. The Asian country reported a surplus with the US of approximately $93 billion less than what the US has reported. Although the Chinese surplus is growing in both reports, it has contracted slightly since the end of the first quarter of 2018. It does not seem that this practice of ceding to Trump’s geopolitical pressure is likely to last long, as it undermines the Chinese growth policy of promoting exports. It ignores the premise of comparative advantage in the production of goods and the provision of services, repatriation of income, and the trend of both countries regarding unilateral transfers.

Source: Prepared by the author with data from Bloomberg and the US Census Bureau

The reality is that US consumers and companies continue purchasing Chinese goods; in fact, US imports grew by 7 percent in the first eleven months of 2018 compared to the same period in 2017. The pressure in the markets has also led to an accumulation of inventories, which in turn is another cause of increases in purchases from China.

China’s Current-Account Balance

We can examine China’s current account (which, along with the capital account, forms a country’s balance of payments) to form a more accurate idea of the country’s economic activity in its industries and capital markets. The current account is defined as net exports plus the sum of net income and net current transfers.

The current account includes four basic components: goods, services, returns on capital, and current transfers. The first two elements usually command almost all of the attention in discussions of the state of this account, but the other two components deserve the same consideration if we want to understand where the trade deficits or surpluses come from and how they are related to direct foreign investment and other forms of investment from abroad, which are recorded in the capital account.

A country’s return on capital is its incoming flows (credits) and outgoing flows (debits) in the form of dividend payments, salaries, direct investments, and other forms of investment. The reality is that although this topic has been absent from the zigzagging speeches of the US president, the yields on capital investments are as important as transactions of goods and services (the trade balance) because they are real resources that are transferred from one country to another.

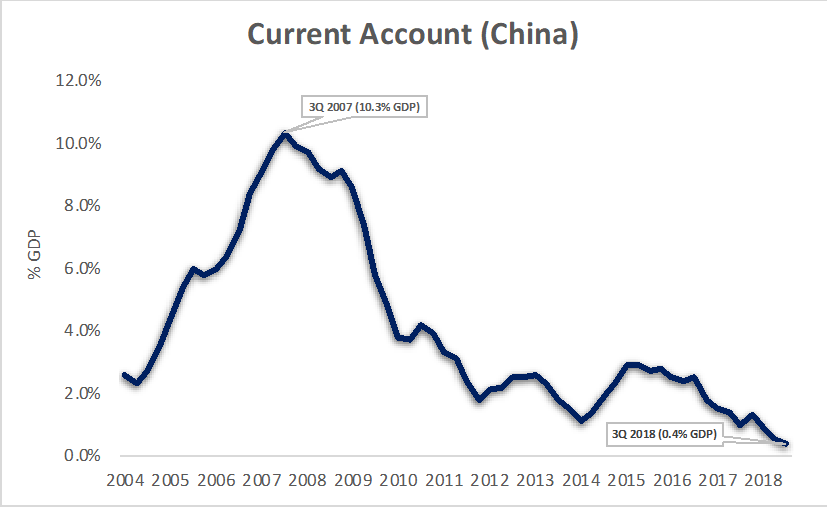

Source: Prepared by the author with data from Bloomberg

Analyzing these components is key to understanding why, in practice, the current account is not equal to zero. Surpluses and deficits do not by definition imply that a country is doing well or not, despite what Trump and those who echo his mercantilist rhetoric may argue. An analysis of the Chinese current account only suggests that in the years prior to the 2008 crisis, the Asian country was strengthening its position as a net creditor to the rest of the world. China, in effect, provided an abundance of resources and accumulated a large amount of accounts receivable.

China and Its Attempt to Open Itself to the World

Trump also seems to forget that China has financed a large part of the US deficit. China’s current account has continued to approach zero since 2015, so it has stopped strengthening its position as creditor to the rest of the world. The fact that the current account is approaching zero can be explained by the continuous increases of foreign investment in China, which are recorded in the capital account.

The capital balance includes foreign investment, both direct and indirect incoming and outgoing financing. The fruits of this invested capital are the repatriation of capital gains, which are accounted for in the primary balance of the current account. China’s famous deficit in the current account in the first quarter of 2018 was due more to a fall in the level of exports of goods ($51.7 billion) compared to the same period in the previous year ($82.31 billion) than to the repatriation of capital (−$9.7 billion in Q1 in 2018 and −$400 million in Q1 of 2017).

However, the Chinese congress recently approved a law to promote foreign investment, which will take effect, in theory, on January 1, 2020. It will guarantee an adequate economic environment for attracting foreign capital.

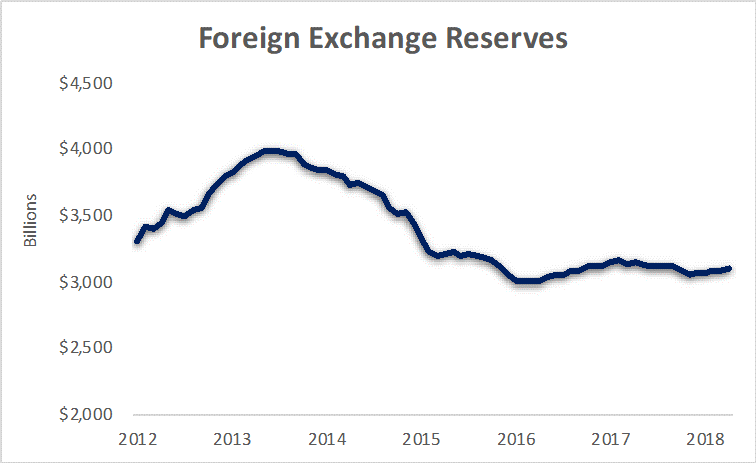

The other main reason for the end of China’s positive current-account balance is the decline in its stock of foreign currency reserves. The reasons are varied, ranging from the expectation of greater outflows of capital to the depreciation of the yuan. In 2018, the volume of reserves fell many times. However, none were especially significant (the largest was a fall of $22.69 billion in September, according to the People’s Bank of China). The outflows are relatively small, especially if you consider that the total volume of reserves of the Asian giant ($3.09 trillion in March 2019) is the largest in the world and that the general level of reserves has remained relatively stable since the last quarter of 2015.

Source: Prepared by the author with data from Bloomberg

Approximately one-fifth of total US imports come from China. The US deficit has widened in aerospace technology and electronic products. Purchases of these capital goods increased by almost $6 billion during the first eleven months of 2018, reaching a total of $160.1 billion. This phenomenon has been one of Trump’s arguments when talking about an “assault on American technology and IP,” in addition to other ruminations that are improper for a position that demands ever more diplomacy and restraint in all forms.

Conclusion

If China wants to reverse the natural commercial order of a balance of payments that reflects the perspicacity of thousands of entrepreneurs, it will have to not only divert its purchases from other countries, but also assume the risk of becoming a captive to US producers. For example, it will have to reallocate almost the entirety of the $160 billion that the US imports in petroleum or the almost $80 billion in agricultural products (less than a quarter comes from the US). In addition, it will have to increase the purchase of aircrafts from the US ($16 billion) as well as industrial machinery, vehicles, grain, and seeds ($13 billion), among other items. Would China be inclined to compromise its growth rate by assigning greater importance to imports from the United States? Are US producers ready to confront this artificial reconfiguration of the allocation of scarce resources?

[1] This paragraph was added on May 14.

[2] The 2020 fiscal year runs from October 1, 2019, to September 30, 2020. The deficit reflects that US government spending reached $4.7 trillion and revenues totaled $3.6 trillion. This is 1 percent more than the deficit of the previous period.

[3] This figure is the amount accumulated in the first eleven months of 2018, updated at the beginning of February according to data from the Department of Commerce.

[4] Small contractions in the trade deficit are due to mere seasonal situations.

[5] It is important to note that the majority of imports to the US of these durable consumer goods did not come from (nor do they currently come from) China.

[6] China included.

Get our free exclusive report on our unique methodology to predict recessions

Diego Santizo

Diego Santizo is an analyst at UFM Market Trends. He has a master’s degree in Economics and a Minor in Finance from Francisco Marroquín University. He is an assistant professor of Economics and related courses at UFM. He is deeply committed with learning, teaching and researching. He is also a multilingual translator.

Get our free exclusive report on our unique methodology to predict recessions

Wonderful website. A lot of useful info here. I am sending

it to some buddies ans also sharing in delicious. And certainly,

thanks in your effort! fussball trikots